How to Decarbonize Aviation? Beyond SAF — Key Pathways to Zero Emissions Flight

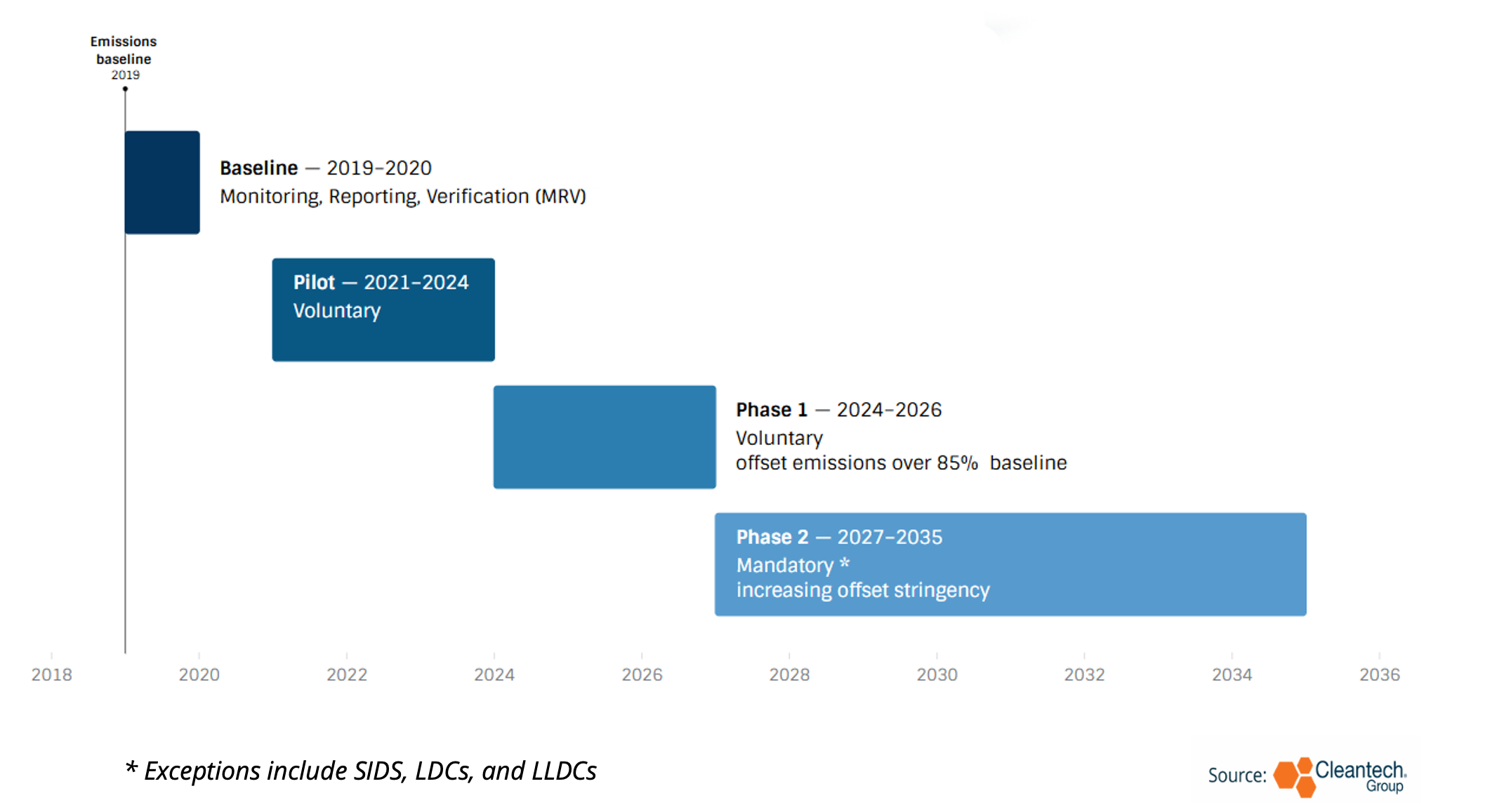

The aviation sector finds itself on the brink of a sustainability transition. This is not a surprise. The International Civil Aviation Organization (ICAO´s) carbon offsetting scheme CORSIA came into effect in 2019, requiring airlines to monitor and report emissions. The first (voluntary) offsetting phase begins this year and will run until 2026 and in 2027 offsetting mandates come into play for most international flights.

CORSIA Phases and Timeline

As airlines and carriers confront the incoming emissions offsetting mandates, complementary decarbonization policies are coming into play as well, namely ReFuel EU, the EU´s sustainable aviation fuel (SAF) minimum uptake requirements. Beginning in 2025, flights leaving Europe must utilize fuel with a minimum of 2% SAF, increasing to 6% by 2030, 20% by 2035, and 70% by 2050. SAF will undoubtedly be a critical piece to the aviation decarbonization puzzle — projections suggest that it may displace more than 65% of industry-wide emissions.

While regulation enforcing these targets is a promising step, the looming 2% uptake mandate is looming closer, and SAF production and uptake is facing significant feedstock and production bottlenecks. As innovators work to address these challenges, airlines, fleet operators, and carriers are evaluating low- and zero-emissions aircraft solutions that complement SAF uptake, reduce fuel consumption and emissions, and offer additional economic opportunities.

Decarbonization Solutions: Aircrafts

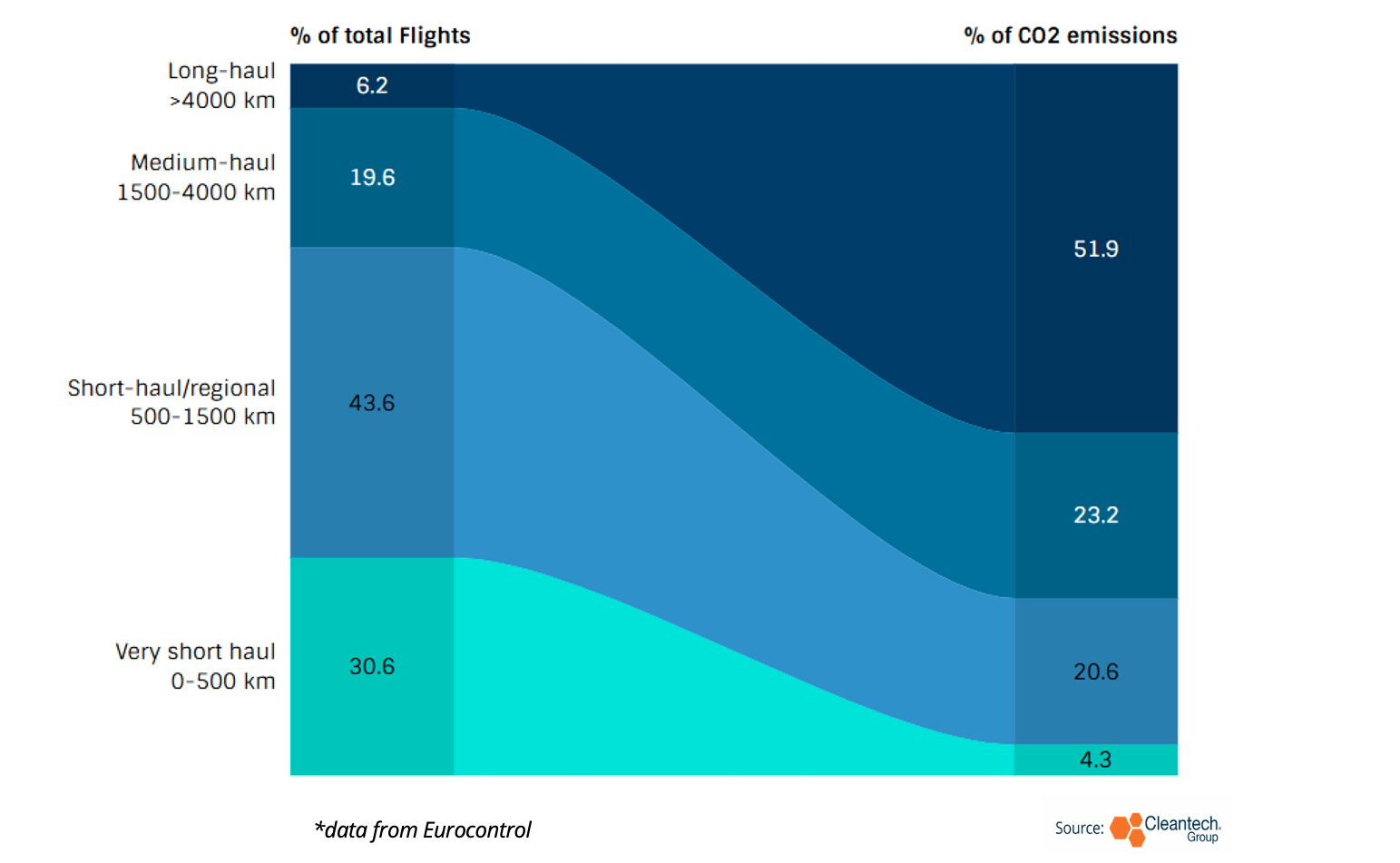

SAF will most likely be the only practical solution to decarbonize the largest aircrafts and longest flights. However, while supply remains low and the cost-premium of SAF exorbitantly high, electric, hybrid, and hydrogen aircrafts provide more cost-efficient solutions for smaller aircrafts and shorter flights, prioritizing SAF use for the most difficult to abate routes (e.g., very long-haul flights). These solutions reduce costs and provide additional economic opportunities for carriers.

Emissions Contribution of Flights by Length

Key Categories of Zero- or Low-emissions Aircrafts

Battery-electric aircrafts

- Pros: Highest energy efficiency of all solutions, proven and mature technology and components, lower operations costs

- Cons: Range and aircraft size severely limited by battery weight

- Key innovation and path forward: Scaling of aircrafts to 50-150 seat aircrafts and increase in range from approximately 800 km to over 1000 km

Fully electric aircrafts will be limited to very small (approximately 9–19-seater) commuter aircrafts, eVTOLs, and unmanned aircrafts even with significant advancements in battery energy density. Hybrid aircrafts, however, are much more versatile, can scale to much larger aircrafts, and add significant emissions reduction (40%+).

Critically, innovators are developing hybrid aircrafts that are compatible both with SAF and a range of battery, electric, and hydrogen propulsion technologies. This flexibility will enable carriers to integrate whichever decarbonization solutions are most cost-efficient. When combined with SAF, aircrafts can reach full emissions reductions while significantly reducing SAF costs through reducing fuel consumption (e.g., Heart Aerospace´s hybrid aircraft provides 40-100% fuel reduction depending on flight length).

Hydrogen aircrafts

- Pros: Potential for much longer range and larger aircraft size than battery-electric, improved energy efficiency of hydrogen use compared to SAF

- Cons: Lower technology and component readiness than battery electric aircraft’s long and complex certification process, hydrogen infrastructure buildout required

- Key innovation and path forward: Commercialization of hydrogen propulsion system and components, advancement in storage and hydrogen fuel cells

Hydrogen aircrafts are a divisive topic. On one hand, they could solve several of the key challenges facing battery-electric aircrafts, namely the issue of energy density. On the other hand, challenges such as hydrogen storage, safety, infrastructure buildout, and the overall availability and cost of green hydrogen raise question marks and are sources of uncertainty.

Innovators such as ZeroAvia are developing advanced fuel cells, hydrogen propulsion systems, and bringing hydrogen aircrafts and components to market more quickly through hybrid aircraft retrofits. Although hydrogen aircrafts will not be market ready as soon as electric and hybrid-electric options, incumbents and corporate investors are investing significantly and engaging with innovators and component developers due to hydrogen aircrafts´ long-term potential to decarbonize regional, short- and medium-haul routes.

Aircraft design and airships

- Pros: Immediate high emissions reduction (50-80%), unlocks airfreight economic opportunities, proven and market-ready technology and components, can use existing infrastructure

- Cons: New-builds more expensive than retrofits, slower overturn in aircraft fleets slows market uptake

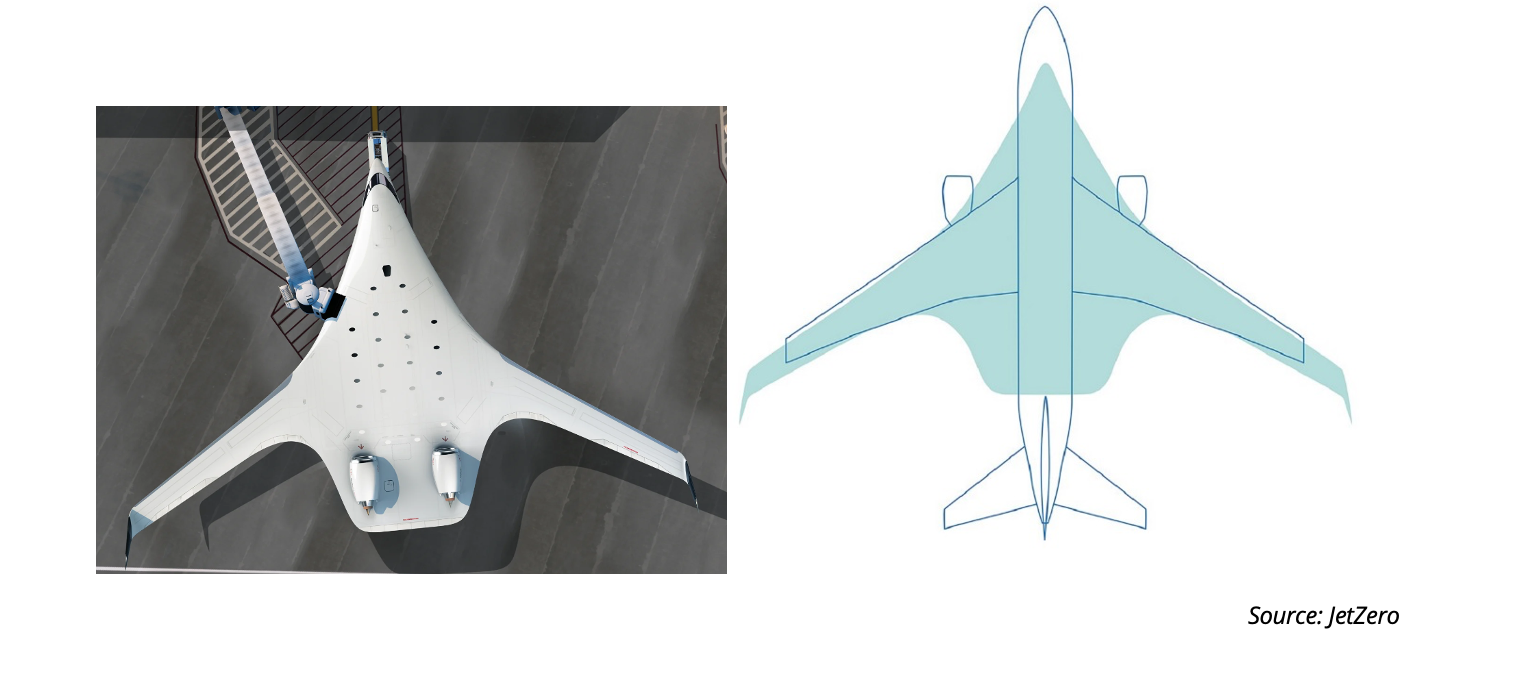

Conventional aircrafts utilize a tube-and-wing design we are all familiar with. However, novel aircraft designs such as blended wing-body improve aerodynamics and reduce drag, increasing range and payload. Innovators estimate between 50% and 80% reduction in fuel consumption and emissions (e.g., JetZero, Natilus) with the potential to reach full emissions reduction when combined with electric propulsion, green hydrogen, or SAF.

Concept of Blended Wing-body Aircraft and Comparison to Conventional Aircraft

Airships are another “novel” aircraft design. Though not a new concept, innovators are developing airships that leverage helium to generate lift, reducing fuel and energy consumption by 75% (100% when paired with zero-emissions propulsion or SAF. While airship developers such as Hybrid Air Vehicles are approaching both the passenger and cargo markets, they have identified airfreight as a key niche market for early adoption.

Airships require minimal runway and infrastructure compared to conventional airplanes, unlocking freight operations for small, remote, and difficult to access airports. Additionally, they target the 20% of aviation emissions caused by airfreight.

Key Takeaways:

- SAF alone will not be sufficient to decarbonize aviation: electric, hydrogen, and novel aircraft designs provide cost-effective solutions for shorter flights and smaller aircrafts

- Uptake of these technologies and SAF will enable prioritization of SAF use for long-haul flights while decarbonizing remaining 95% of flights (shorter haul, smaller aircrafts)

- As battery, zero-emissions propulsion, and hydrogen component technology improves, solutions can be scaled up to longer flights and larger aircrafts

- Hybrid solutions will be fastest to market due to shorter certification processes and integration into fleet upgrade schedules

- Solutions that are technologically proven and offer clear operations cost reductions and futureproofing (e.g., compatibility with electric, hydrogen, and SAF) are most attractive to airlines

- Technology and certification hurdles remain for hydrogen aircrafts, but investment and engagement from incumbents remains strong due to long-term potential

For an in-depth look on SAF and eJet innovation, see past publications: Innovation Takes Flight with SAF and SAF: the Rise of eJet.