2023 In Review: A Soft Landing on the Right Side of the Pandemic

2023 was a year marked by shifts, adaptations, and grappling with new macroeconomic realities within cleantech. While concerns over venture funding drop-offs in cleantech and the broader tech industry garnered significant attention, the year has brought forth notable trends and developments that deserve recognition.

Venture Funding in 2023: Light at the End of a Long Shadow

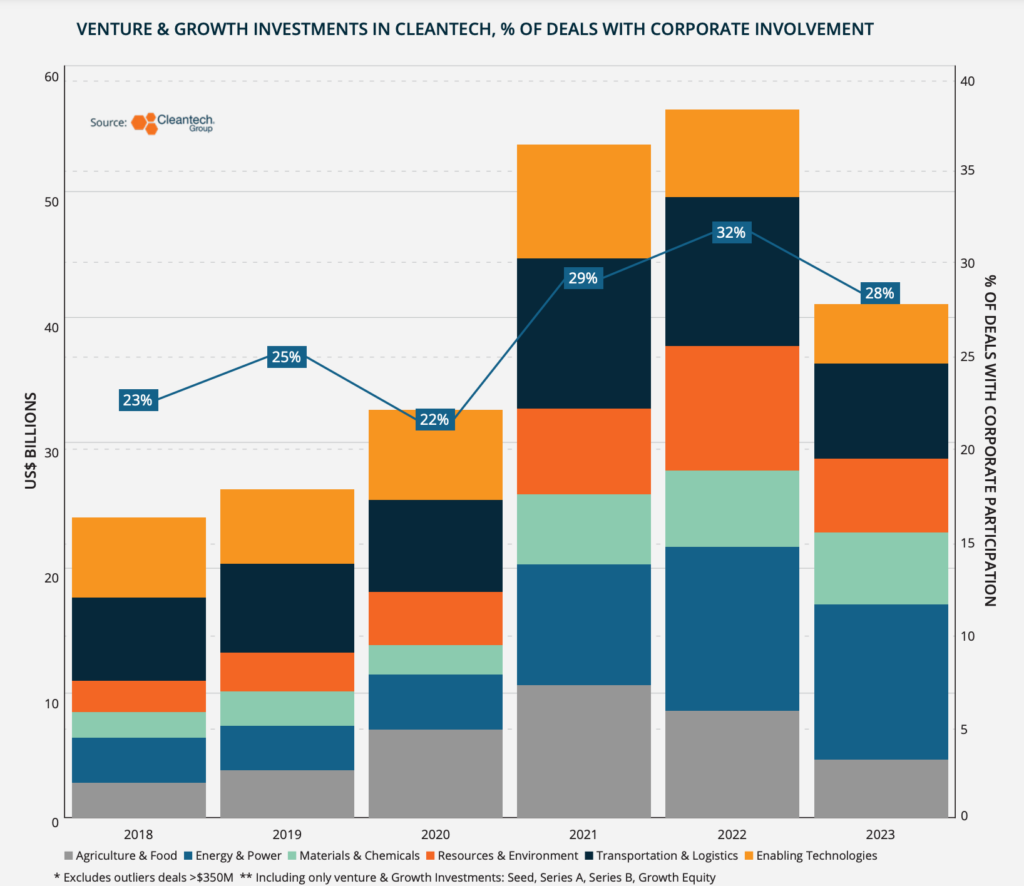

It is undeniable that 2021 and the first half of 2022 witnessed an unprecedented surge in venture funding for cleantech innovators. However, as we stepped into 2023, it became apparent that the record-breaking figures of those outlier years would not be repeated. The long shadow cast by the low-interest rate years should not crowd out the fact that the overall upward trajectory, over time, in cleantech investment remained intact.

Encouragingly, corporate involvement in venture rounds has stayed closer to 2021 and 2022 than the years prior. Corporate participation in 2023 venture rounds of this year’s Global Cleantech 100 companies was highly visible.

Narrowing Landscape in Mergers and Acquisitions

The mergers and acquisitions (M&A) landscape experienced continued cooling in 2023, following a sharp decline in 2022. IPOs of venture-backed cleantech companies have notably slowed since 2021, with innovators increasingly opting for exits through acquisitions. IPOs, which were once a popular choice, have plateaued at levels similar to those seen before the pandemic. Special Purpose Acquisition Companies (SPACs), once seen as a promising listing route, have lost their appeal due to the inability of many SPAC stocks to perform well in the public markets, resulting in some companies opting for private acquisitions at valuations lower than their initial listing prices.

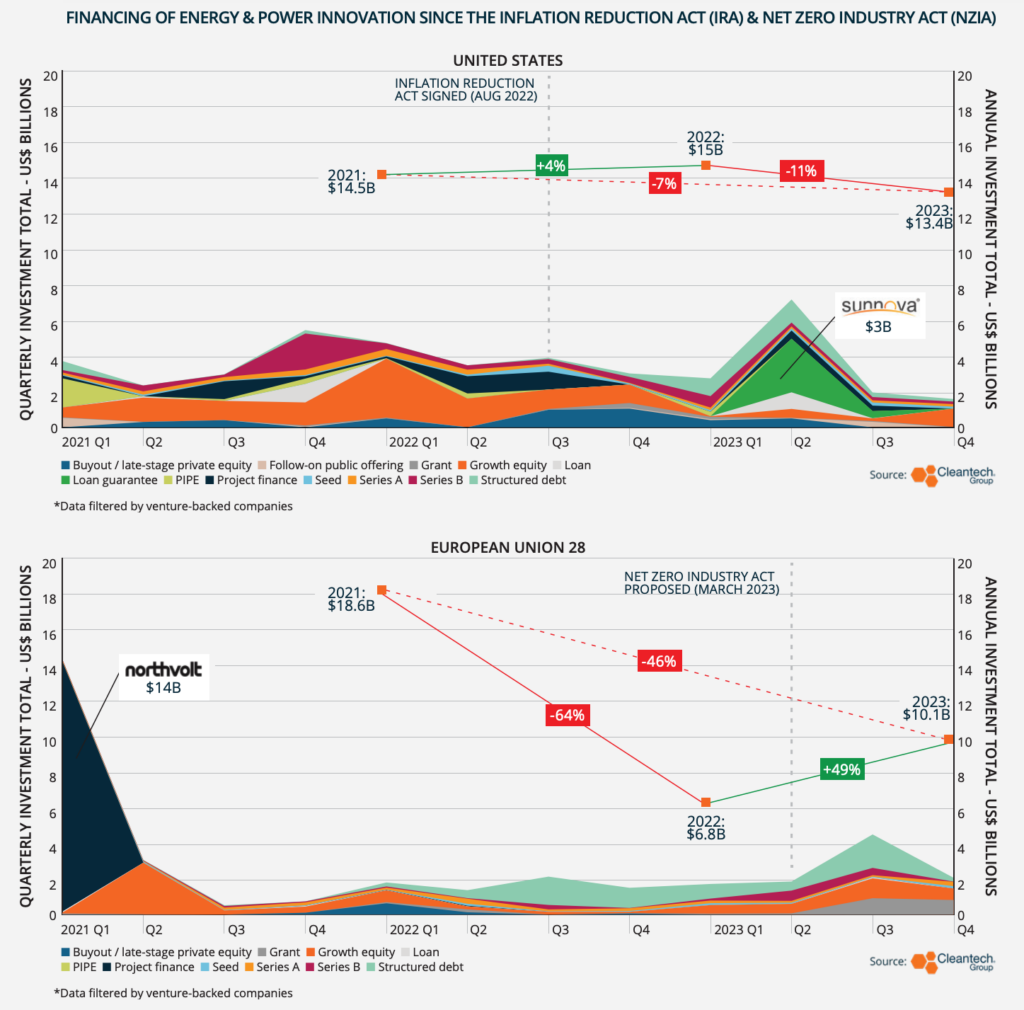

The Inflation Reduction Act: A Year of Impact

The Inflation Reduction Act (IRA), arguably the most significant clean energy catalyst in the U.S., has played a pivotal role in de-risking private sector investments. This legislation has already begun to show its effects, with energy and power innovators in the U.S. experiencing notable changes. Venture-backed U.S. innovators diversified their financing sources in 2023, moving away from a predominant reliance on equity. This shift reflects a growing bankability among U.S. innovators’ business models, alleviating the impact of higher interest rates that typically raise the bar for equity investments.

Comparing the U.S. cleantech landscape to its Transatlantic counterpart, U.S.-based energy innovators experienced a robust 2022, with 2023 delivering similar performance. However, the Net Zero Industry Act (NZIA) in the European Union has begun to make its presence felt. The second half of 2023 witnessed a significant upturn for European energy innovators, contrasting with a less favorable first half.

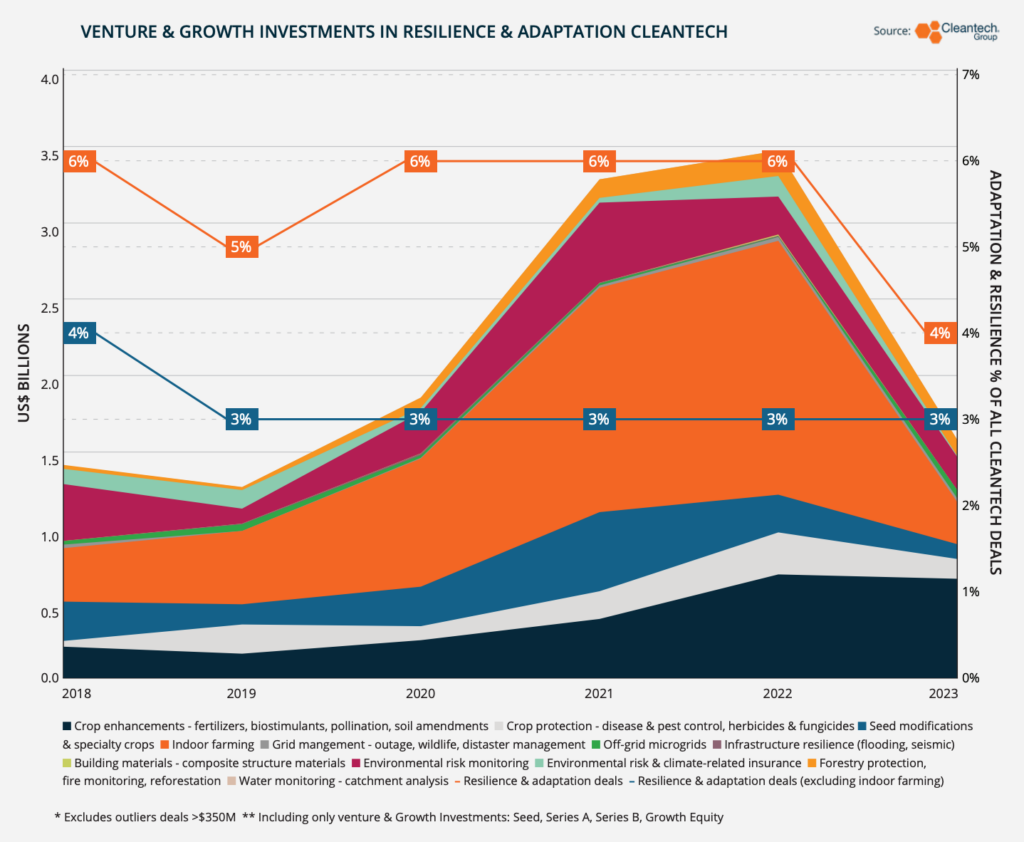

Resilience and Adaptation: An Under-engaged Imperative

Revisiting a trend acknowledged in last year’s Global Cleantech 100, investments in technologies supporting climate adaptation and resilience have remained relatively flat as a percentage of overall investments. This prompts us to wonder how prepared we truly are for the forthcoming challenges posed by climate change.

Where urgency is being sensed, however, is in innovation for crop resilience. For years indoor farming was a key underpinning of resilience and adaptation cleantech. In the wake of multiple indoor farming bankruptcies, there is still reason to believe that the Agriculture & Food industry group will be one of the first to draw on innovation, as it seeks to make food systems against changing weather patterns while hitting the moving target of population growth. Taken together, crop enhancements, seed modifications and specialty crops, and crop protection have collectively experienced only a minor drop off and remain stronger than in the pre-pandemic days.

Watch the crop inputs space closely. As microbial inputs that sequester carbon expand revenue-stacking for farmers (yielding more crops and selling carbon credits) and the ammonia fertilizer market grows as one of the first demand sources for green hydrogen, we believe the gravitational pull of this currently under-recognized space will grow. Expect to see crop resilience innovation become less of a niche and more of a cross-cutting theme, with supply chains forming around them as business models become more apparent and attractive.

Pandemic Shifts to the Rear View, A Critical Decade Lies Ahead

Undoubtedly, the Covid-19 pandemic and its far-reaching economic implications have provided the backdrop to many discussions about the potential of cleantech innovation in recent years. In our previous assessment, we anticipated that innovators would transition into a “new normal,” characterized by a more cautious fundraising environment and prudent corporate expenditure on novel technology ventures. This prediction has largely held true, albeit with some unexpected twists.

We predict that 2024 will be the first year that we get a glimpse into the “next normal” – the coming era of seeing today’s innovation succeed or fail in the mainstream – many of the spaces we’ve tracked by venture investments for nearly the past decade will start becoming measurable in manufacturing statistics and product price (keep an eye out for a follow-up post next week digging into technology trends).

In the 2024 Global Cleantech 100, we expand more on these trends and take a closer look at the companies that will play a key role in advancing them through 2024.