2024 Cleantech 50 to Watch

It is our pleasure to bring you this sixth edition of the Cleantech 50 to Watch. As our last edition of the early 2020s, I predict that we will look back at this list and the associated analysis behind it with great reflection. Just a few weeks from now, the U.S. presidential election will be decided, and the ensuing months will involve a flurry of activity – in one direction or another – to react to the reset expectations for the second half of this decade. The challenges are compounding, but the trajectory of early-stage cleantech innovation towards the harder problems and deeper reinvention is continuing as well.

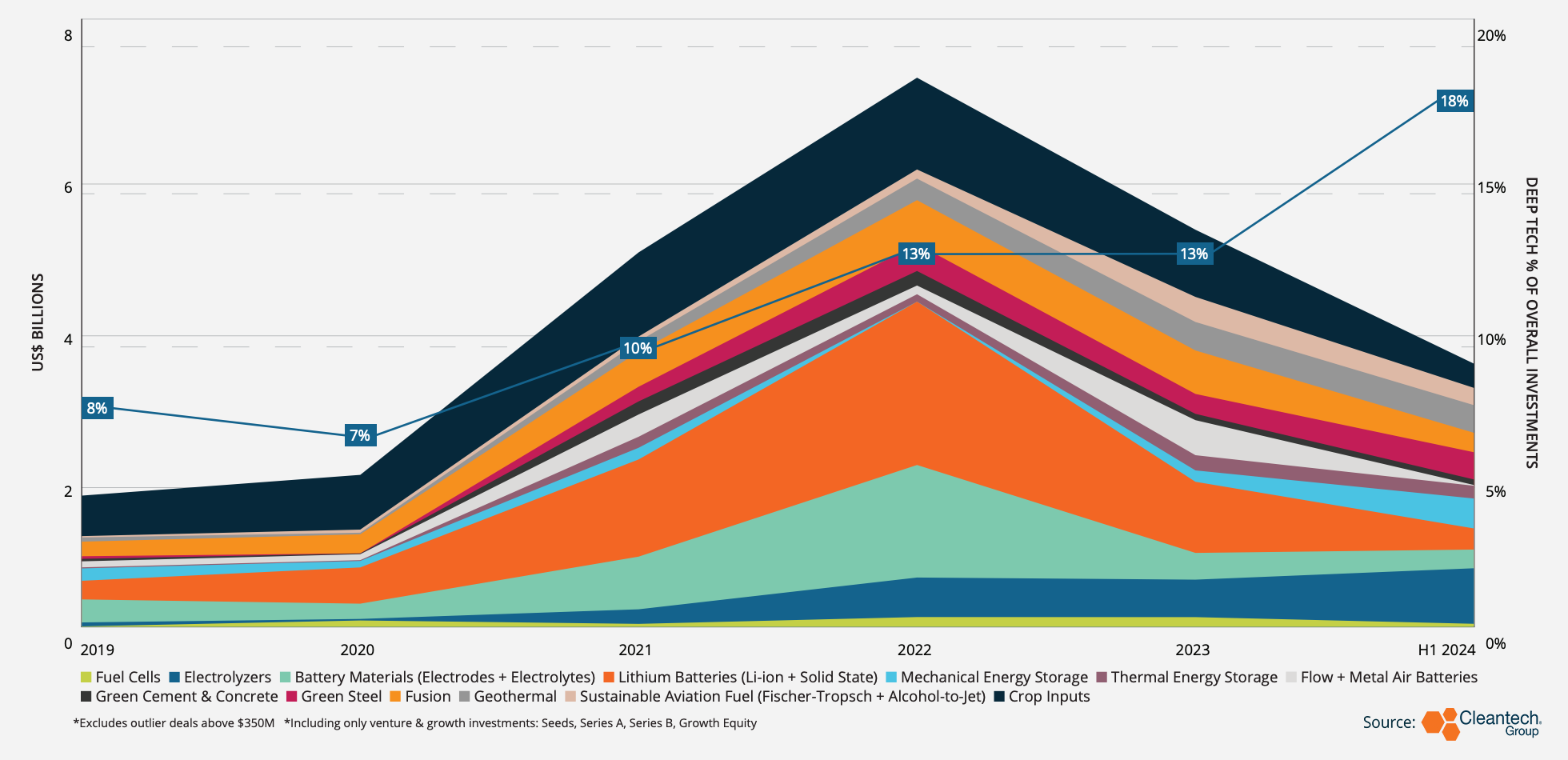

The Deep Tech Dynamic Continues to Evolve

We noted with enthusiasm last year that, from what we’re observing, an important reality had begun to sink in that the lowest hanging fruit had already been picked, and deep tech innovation was slowly becoming recognized as the long-term growth frontier in cleantech. This trend has only strengthened in the first half of 2024 – some areas even outpacing their 2023 totals already.

Cleantech Venture & Growth Investments by Deep Tech

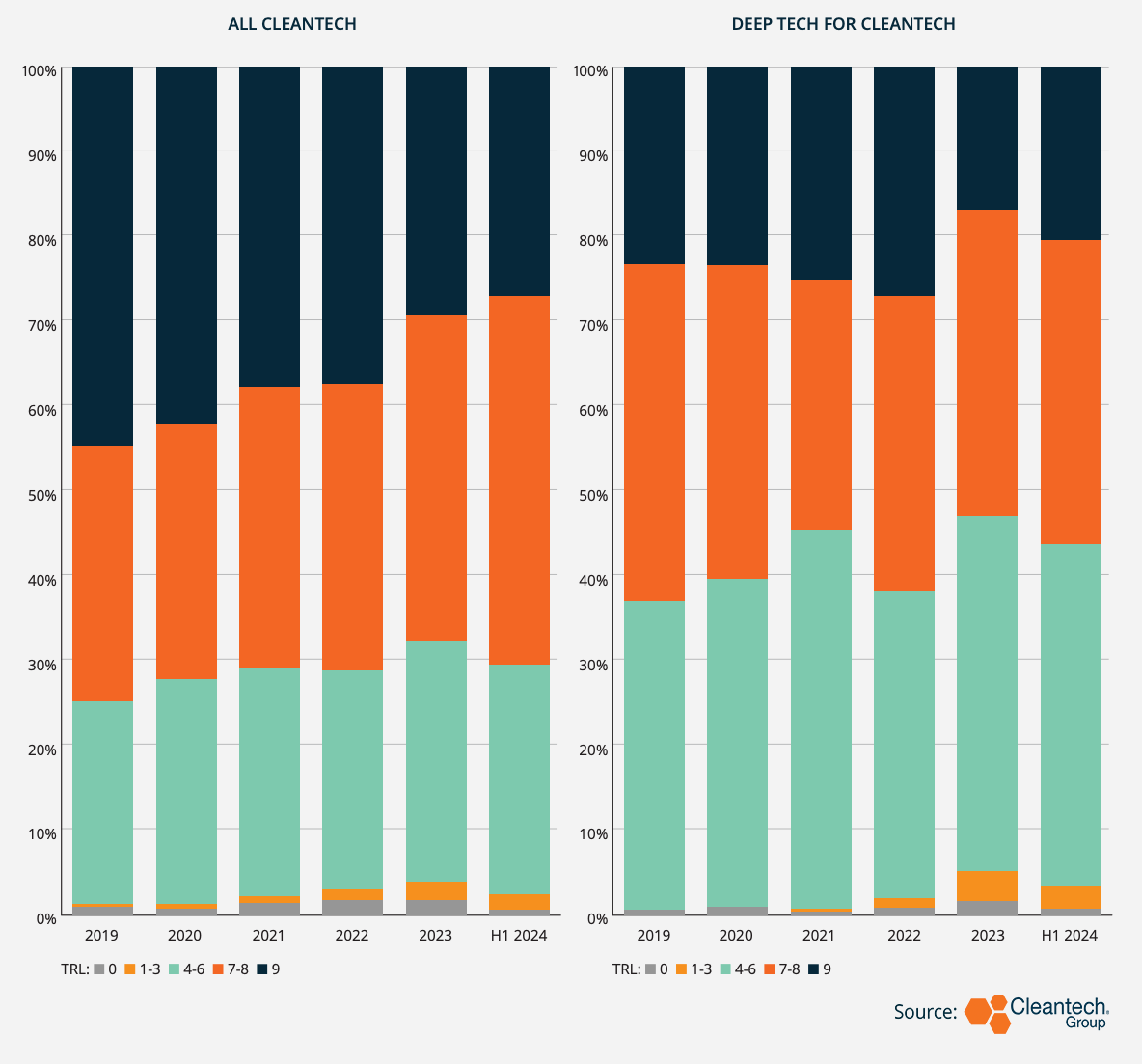

The learnings from a wave of first-of-a-kind projects over the past few years are reducing perception of risk in many of these spaces. Take as an indicator, the fact that when compared to recipients of funds in deals across cleantech, deep tech innovators are raising funds at slightly lower TRL levels. There is, of course, a degree of multicollinearity here (only those investors confident in deep tech will make the investments), but the fact that the past 18 months is the strongest demonstration of this trend is likely not a coincidence. Perhaps more important, as more deep tech innovations stand up in physical form (pilots, demonstrations, first-of-a-kind commercial operations), the financial risk profile will begin to soften as well – expect more in the spaces below in the coming years.

Technology Readiness Level of Venture Funding Recipients

Recent favorable policy environments have begun to stimulate a leapfrog effect as the successes and failures of the current “wave” of innovation are borne out. Take hydrogen as an example – much of the focus in recent years has been on cost reduction in on-site electrolysis technologies. While that is still important, we see some innovators cropping up that are pursuing alternative approaches:

- Hydrogen carriers for conventional infrastructure – Cleantech 50 to Watch companies like Ayrton Energy (converts hydrogen into room pressure carrier oils) and Rift (produces iron fuel with a hydrogen input for storage in standard steel tanks) can be an unlocking agent for geologic hydrogen and other centralized sources

- Low or no-hydrogen ammonia production – a key beachhead market for clean hydrogen is ammonia for fertilizers (and potentially shipping fuels)

- Cleantech 50 to Watch companies NitroFix and Swan-H are synthesizing water directly without an external hydrogen input

- Nitrovolt has developed a “Nitrolyzer” that pioneers the use of a lithium-mediated ammonia synthesis process, also with the goal of eventual ammonia production from air, water, and electricity

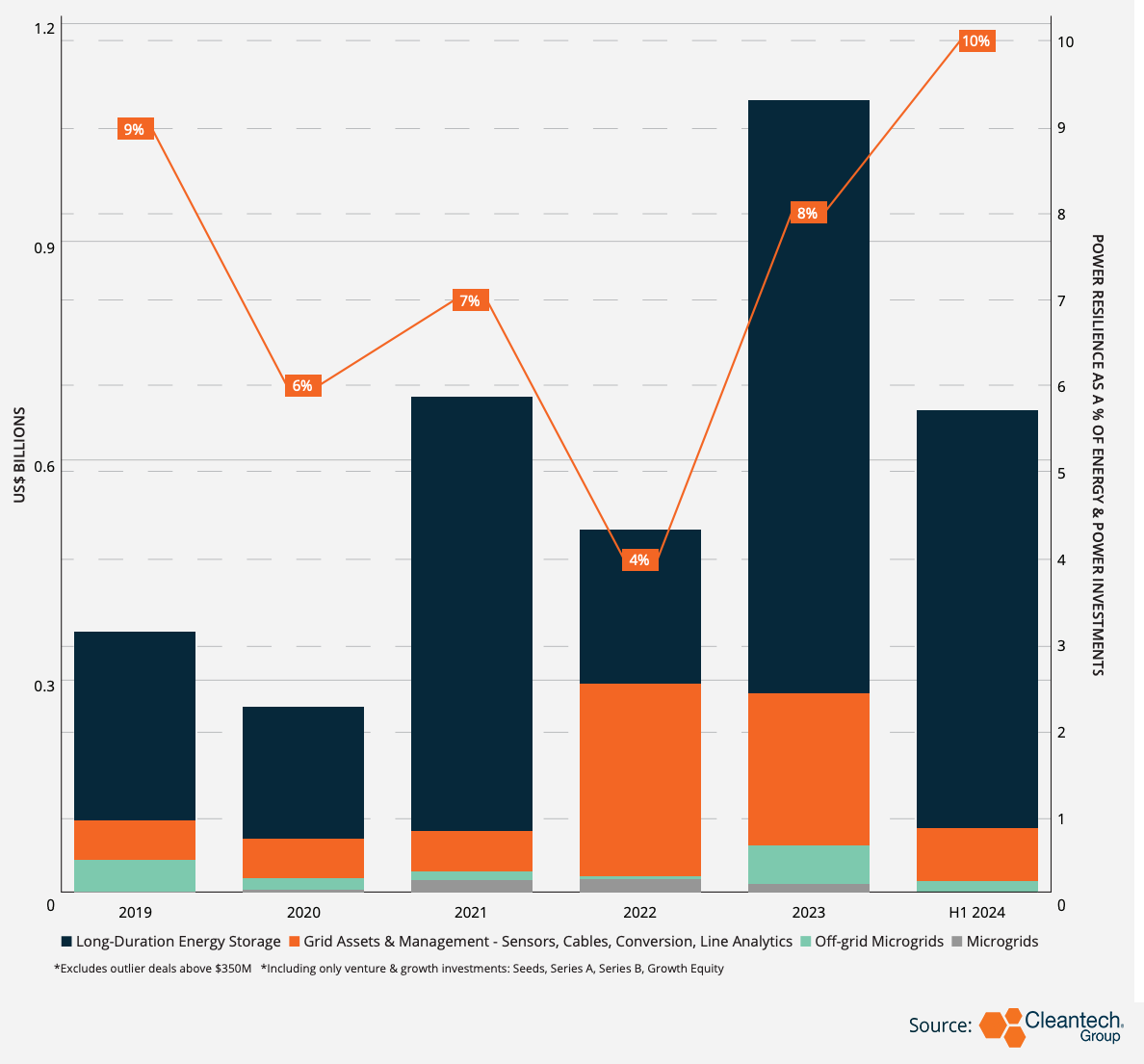

Grid Resilience Urgency Well Reflected in Innovation

As the world gears up to add an estimated 3,700 gigawatts (IEA) of renewables through 2028 and serve a generational growth in power demand from data centers, electrification of industry, and EVs, there remains an overarching threat of weather events toward existing and future grid infrastructure. Innovators are getting the message loud and clear.

Venture & Growth Investments in Power Resilience

Just in this year’s Cleantech 50 to Watch, we see innovation spanning from smarter grid planning and optimization to reinvention of fundamental grid hardware. The role of AI can be traced throughout all the companies landing on this year’s list.

- Rhizome is a grid planning and monitoring platform that models resilience threats up to 50 years in the future, for deep de-risking of grid investments

- ThinkLabs is providing physics-based digital twins for critical renewable energy and grid infrastructure

- Also leveraging digital twins, Grid Raven models wind impacts to the meter to provide granular dynamic line ratings, supporting better grid capacity and resilience

- Ionate is reinventing the electrical transformer inner workings without reinventing the form factor through high-precision electromagnetic power flow controls

Textiles & Plastics – A New Innovation Cycle Begins

After decades of e-commerce and the growth of the fast fashion segment, an accumulation of textiles waste has become a global challenge to be reckoned with. Policy changes are on the horizon, most recognizably in the EU, with visible strategies to mandate more sustainable design of textiles and intensify support of circular supply chains. Innovators are responding to the challenge, and, while the absolute investment figures don’t show it, this has quickly become a core area of waste and recycling innovation.

The textiles sustainability theme shows up in a few places in this year’s Cleantech 50 to Watch list, with companies seeking to impact the recycling of textiles and production of virgin textiles:

- Refiberd is leveraging AI and hyperspectral imaging for textile sorting

- Simplifyber is flattening the leather manufacturing process through an additive manufacturing process that enables use of biobased and recyclable materials

While improved plastics sortation and recycling processes like depolymerization and dissolution are increasing plastic recycling rates, virgin plastic production and plastic-related emissions are set to triple and double, respectively, by 2060. However, a look through this year’s Cleantech 50 to Watch shows an encouraging diversity of approaches entering development, both on plastics supply and management:

- Mushroom Material is upgrading mycelium agricultural waste into a biodegradable Styrofoam replacement

- FlexSea has developed novel biomaterials derived from renewable marine resources to replace plastic packaging

- Macrocycle Technologies has developed a plastics recycling-to-product process using synthesis of cyclic macromolecules (macrocycles)

- Atacama Biomaterials is pioneering an AI-driven formulation engine to develop biomaterials without natural feedstock restraints

We’d like to extend our congratulations to all recipients of this year’s Cleantech 50 to Watch awards. As always, we want to hear from the wider cleantech community as well – please feel free to reach out with new innovations that you believe will impact the world in coming years.