Energy and Power Takeaways from Cleantech Forum Asia

For two days, Cleantech Forum Asia hosted a plethora of local, regional and international players in the energy sector. Despite the mix of perspectives, there was evidence of common patterns. In speaking to many of the industries attendees, four key themes emerged.

1. Improving legacy infrastructure

Despite the rate of new infrastructure development reaching its highest point, Asia is seeing a wave of innovation focused on improving the energy efficiency of legacy infrastructure. UK company, Bowman Power, discussed how its technology can reduce emissions and also reduce fuel consumption of existing gas and diesel fuelled engines and gensets. The company is keen to work with Asian partners to reduce the huge amount of waste that existing assets currently produce. The product could be retrofited into ~400,000 industrial engines and an estimated 10 million on and off highway vehicles per annum, which equates to more than the entire CO2 emissions in the UK from the use of fossil fuels in 2018.

2. Economics first, CO2 second

Another interesting trend is the business model strategies some of the innovators are using to approach Asian customers. Given the conservative nature of some of the old incumbent infrastructure companies, the reluctance to embrace solutions sold on the value of CO2 reduction is a barrier to market entry. Consequently, innovators looking to do good business across the region are primarily selling solutions based on economic value through, CAPEX free business models, with CO2 reduction kept as a secondary benefit in the offering. CarbonCure Technologies is a CO2 utilization company which has used its technology across 150 plants globally. They detailed that while only having 3 plants across Asia today, a ZERO capex model will enable them to quickly attract new Asian customers their ability to capture and inject the waste CO2 into fresh concrete, thereby dropping the costs.

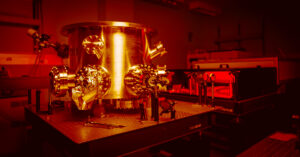

3. Hopes for Hydrogen across Asia Pacific

Across the region, there is a sense of optimism for the opportunities hydrogen can create. For countries such as Australia, which has a relatively high percentage of solar penetration on the grid, the opportunity for “exporting renewable energy” via hydrogen electrolysis to other countries which typically import energy (Korea, Singapore) is real, and is driving an accelerated volume of public/private funding. While the opportunities are promising, most attendees feel there is a current knowledge deficit in hydrogen development expertise. More expertise is needed to provide integration support across the value chain. Hiringa Energy is looking to be that stakeholder in New Zealand and beyond, with a goal of establishing the production, distribution and refuelling infrastructure to enable the adoption of hydrogen solutions.

4. Meaningful CO2 reduction

How Asia is ultimately going to see a deep level of decarbonization was a common conversation point throughout the conference. The long-term advantages of innovation providing incremental CO2 reduction, compared to those addressing the more expensive, but more impactful reduction are often unclear when capital is invested in early-stage companies. There is a feeling that there will never be any real meaningful influence in CO2 reduction while coal remains such as big part of the energy picture. China, for example, is expecting hydrogen fuel to account for some 10% of the Chinese energy system by 2050 (See my research here on Hydrogen in China), but while the country remains focused on coal (with coal gasification 20% cheaper than hydrogen from natural gas production, let alone green hydrogen), the hydrogen economy in China will most likely follow the money and therefore, still heavily rely on CO2 based solutions in the near term.

Looking for more Insight into Cleantech Innovation across Asia Pacific?

Meet the APAC 25 – the companies working to deliver a decarbonized future across the region and beyond.