Smart Grid Flexibility Markets – Entering an Era of Localization

As renewable energy power continues to proliferate, localized, real-time flexibility at both the supply and demand level is becoming instrumental. Project Drawdown ranked Grid Flexibility 77th on their list of climate solutions, seeing it as an essential to enable 80% of energy generation to be renewable by 2050.

“Grid Flexibility” refers to the capability of a power system to maintain balance between generation and load during uncertainty, resulting in increased grid efficiency, resiliency and the integration of variable renewables into the grid. The concept is not new, with every grid in every country having some degree of flexibility. Historically, on the supply side, grid operators responded by adjusting supply, either turning pumped hydro, nuclear and gas cycled generators on or off, or up or down, as needed. On the demand side, demand response has been used to provide value through peak demand reduction and represents the largest distributed energy resource in the US, providing 60 GW capacity of dispatch.

However today, driven by macro trends, grid flexibility is evolving:

- The uptake in renewables is increasing intermittency in supply, growing the need for grid balancing.

- Low-cost alternatives to physical grid infrastructure upgrades are needed to maintain grid resiliency and to accommodate growth of distributed energy resources at the grid edge.

- Increased asset electrification and a global increase in electricity demand is inducing new grid capacity constraints.

- Broader availability of sensors, data and big data control systems is enabling visibility over grid systems.

As a result, the flexibility market is witnessing a range of major shifts:

Globally, flexibility providers are diversifying to include utility-scale energy storage, residential energy storage, smart buildings, amongst others, participating and capturing value from grid services. These new grid flexibility providers are offering smaller,more flexibly suitable loads, which is starting to be encouraged by network operators such as UK Power Networks who are looking to procure smaller bid volumes as low as 100 kW. In addition, the transportation sector is witnessing a surge in electric vehicles uptake, which are being connected to the grid, creating additional grid flexibility.

Business Models

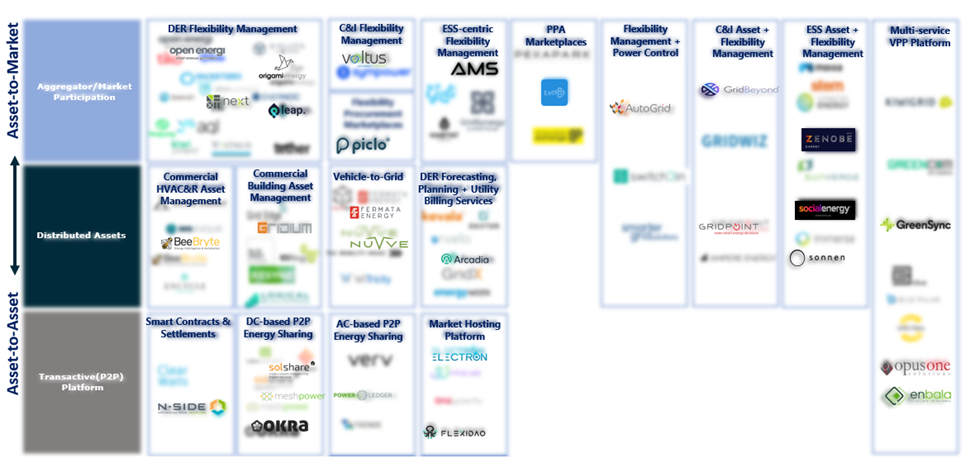

As ways to procure, manage and market new forms of flexibility increase, innovators are developing new business models. The figure below highlights the business model innovation landscape for flexibility.

Figure 1: Flexibility business model ecosystem

Figure 1: Flexibility business model ecosystem

Flexibility Aggregators

Innovators aggregating flexible load such as Next Kraftwerke and GridBeyond are helping enable wholesale market participation and short-term savings where traditional market structures remain an integral component of system design. Building on its domestic success, load aggregator Next Kraftwerke is now offering VPP-as-a-service to large C&I customers and utilities in emerging markets in Asia where demand is high but established VPP solutions are limited. The model is proving successful in parts of Europe and North America, owing to favorable government support and large renewable deployment. With more progressive regulation being implemented across Asia Pacific in 2019, the region is anticipated to show the highest DER growth, especially in India, China, Japan and Singapore.

Flexibility Procurement Marketplaces – The Aggregator of Aggregators

In order to help flexibility aggregators, manage and auction in their pool of loads, innovators such as Piclo and Leap have introduced an independent marketplace for supporting the procurement and management of flexibility. By marketing all flexible load in the same place, transaction costs and complexities can be significantly reduced. Piclo has a large share of the UK market, currently with over 300 flexibility providers on their marketplace, including flexible aggregators such as Kiwi Power and Open Energi, and standalone independent power producers (IPP). Leap has a majority share of flexibility providers in the California area, which they have procured via strategic partnerships with Googles’ Nest Smart Thermostats (procuring residential HVAC) and also Axiom Exergy, procuring commercial refrigerator flexibility.

Multi-service DER management Platforms

As well as aggregating and managing flexible assets, innovators are offering multi-service virtual power plant services, which can monitor, manage and optimize energy asset in real time. DER management innovators have typically specialized in solving grid problems for utilities and operators in specific geographies where needs vary depending on regulation and competition. However, innovators such as Enbala, GreenSync and Opus One Solutions are now bundling different DER products into a single multi-service platform. These platforms can cater for a range of cross-border customers who sit at different stages of the energy transition with different regulatory hurdles.

Transactive Energy Platforms

Away from the primary energy markets, technology is now bringing DER management closer to the edge of the grid and away from centralized control rooms. Transactive energy trading platforms are moving from pilot to commercial level in energy markets where regulatory conditions allow for it. WePower Network has several ongoing large-scale pilots, where grid operators at the distribution level are given a more active role in DER management, allowing the flexibility provider to transact energy locally

Geographic differences

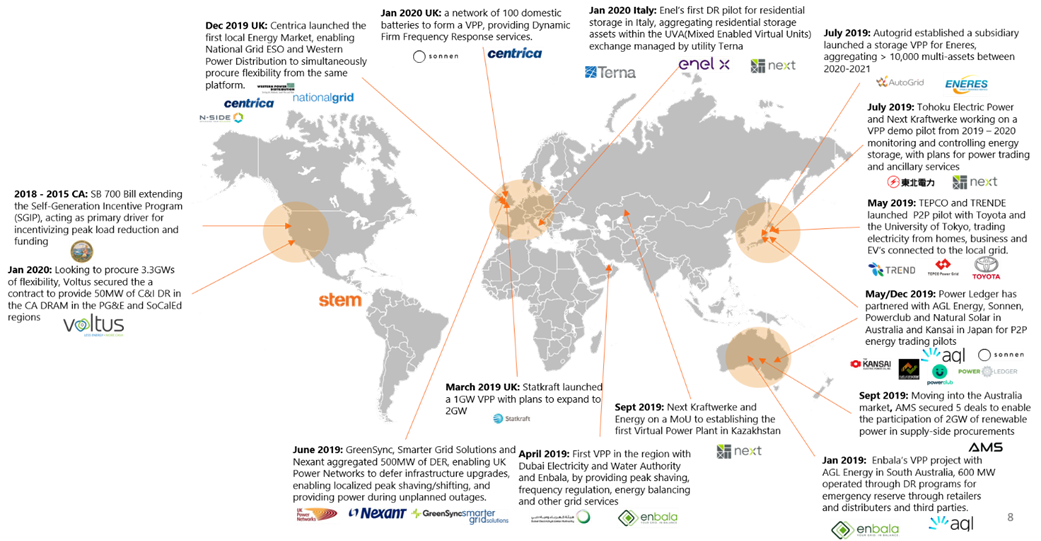

In particular, the UK, the US, Central Europe, Japan and Australia are current flexibility hotspots. The figure below highlights some of the innovation projects globally.

Figure 2: Flexibility projects and pilots

Figure 2: Flexibility projects and pilots

Europe has a highly integrated grid flexibility market, historically focused on renewable integration and supply-side aggregation and it is starting to adapt to advanced multiservice grid participation services. However, Central Europe could benefit from additional market reform including the modification of market rules allowing for simultaneous flexibility procurement, smaller bid volumes and the aggregation of smaller flexibility assets. Germany and the UK remain leaders, but other markets are opening up. including Italy, Estonia and Poland.

In the US, California remains the clear market leader for behind-the-meter battery opportunities, driven by the Self-Generation Incentive Program, acting as primary driver for incentivizing peak load reduction and supporting companies including Stem, Green Charge Networks, Tesla and others.

Challenges

In many countries, completely localized renewable flexibility tenders still largely depend on subsidies and will need time to develop to be competitive. Flexibility Aggregators also face limitations within the power market including:

- incomplete grid datasets;

- imperfect coordination of agents’ responses to economic signals; and

- irrational price responses which ultimately limits the ability to deliver optimal deployment of capacity at scale.

For the emerging business models such as transactive energy, a lack of proven value stacking strategies and tough regulation means the market still needs time to mature before we see wide-scale adoption.

Impact of Covid-19

For the most part, it is too early to measure how the flexibility market will be impacted by Covid-19, however early reports indicate a 10-20% global drop in energy demand. Thomas Folker, CEO at Leap, told us in California that they have already seen increasing demand from water districts, a large drop off in demand from vehicle charging and a significant shift of HVAC usage (moving from peak weekend/evening usage to midday as people work from home).