Corporate Renewable Energy Procurement: Traceability and Energy Provenance

Corporate renewable energy procurement is booming. In 2019, over 400 companies committed to science-based targets. If companies hit their 2030 targets, the demand for renewable procurement over the next 10 years will see over 105GW of new renewables deployed. Corporate buyers are looking to satisfy a range of lasting impact requirements for energy procurement, with a key interest in additionality (new renewable energy capacity) and locationality (where their renewable energy comes from).

But what if I told you these companies could be significantly overstating their emission reductions through current accounting methods? A Stanford University paper published in May 2019 found that “by 2025, the use of yearly averages in California could overstate the greenhouse gas reductions associated with solar power by more than 50% when compared to hourly averages”. Today’s accounting methods fail to factor in:

• Matching of real-time energy consumption profiles

• Validating the provenance of clean energy from buyer to seller

Currently, Energy Attribute Certificates (EACs) such as the US Renewable Energy Certificates, European Guarantees of Origin and International Renewable Energy Certificates (I-RECs) provide evidence for energy provenance per MWh. The problem is, the reporting methods don’t satisfy modern demands.

In practice, existing accounting methods for EACs reflect average consumption and production over a year. Therefore, corporates which claim to have reached 100% renewables are, in truth, purchasing enough EACS to match 100% of their electricity demand over a 12-month period, not sourcing their electricity directly from clean energy projects.

Furthermore, as EACs can be bought from any time period or location, corporates are incentivized to purchase low cost EACs to support sustainability claims, failing to incentivize directly matching production with consumption.

Matching Renewable Energy Procurements to Time of Consumption

If corporates wish to ensure their investments are having sustained impact, they need to transition from prioritizing “additionality” (adding new renewable generation to the grid) to prioritising emissionality (supporting procurements which maximize the positive emissions impact of their investments).

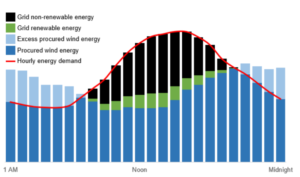

In order to achieve this, in addition to aligning the location of the procurement, corporates must also align the time that renewable power was produced with the exact time that the energy was used, known as energy traceability. The figure (above) illustrates a model for hourly-matched renewables using traceability, showing the shortfall that annual procurement methods fail to accommodate.

The market for traceability is just getting going. Today, only a handful of top RE100 corporates are activity engaged in or looking closely at the time-tracked renewable procurement, on top of their additionality and locationality strategies. In addition to load matching, tech-driven traceability is poised to reduce management and transaction costs associated with traditional trading mechanisms. Today, venture appetite remains largely in its infancy, which can be attributed to the relatively small number of ready buyers and the early stage of the technology.

Innovator Business Models

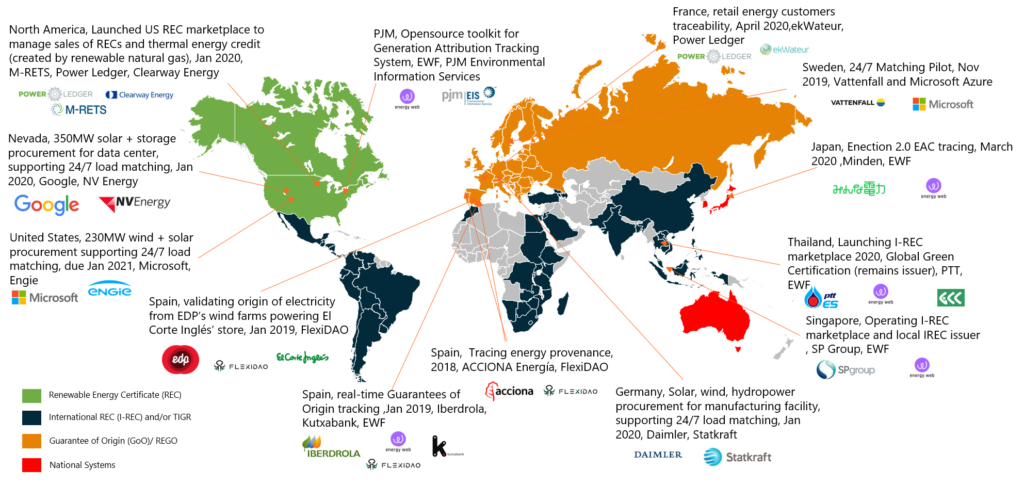

Innovators are introducing technology via different product offerings to cater for varying classes of buyers in different markets. Early movers are directing piloting technology in their own portfolio of assets, some are selling attribution software as a certificate sleeve and others are considering a marketplace approach. The figure (below) highlights some of the time-matched projects worldwide.

Various innovator business models are emerging as outlined below:

Buyers who are already looking for time-matched renewables

- Buyers who made early strides in their climate commitments are exploring 24/7 load-matching to gain clarity into their energy usage which can, in turn, be used to support emissionality claims.

• Piloting technology on their own projects, gaining experience on assets they directly own.

• Google publicly announced a plan to match 100% of their annual electricity consumption through direct purchases of renewable energy.

Directly selling traceability software

- Microsoft (who announced a new climate strategy in January), partnered with Vattenfall to develop a hourly-based energy tracing service at Microsoft HQ in Sweden. The company also hopes to inspire regulatory change to allow future products such as theirs to play a role in the market at a faster rate.

- Start-up Power Ledger, develops trading technology and has pilots underway. “Vision” allows users to track and certify energy provenance. The company partnered with French renewables supplier ekWateur, offering traceable Guarantee of Origin to customers. The company has a partnership with Alperia SpA to pilot energy tracing for Italian green energy customers.

Selling traceability products to utilities/retailers

- Innovators can tap into a broader utility customer base, limiting technology buy-in risk.

•Barcelona-based innovator, FlexiDAO was accepted onto the Free Electrons 2020 Digital Cohort in March. FlexiDAO offers utilities a software to unlock new digitized energy services for their corporate consumers. FlexiDAO is working in 9 countries with 7 utilities including Acciona, Iberdrola and EDP, 22 corporate consumers and tracked 3 TWh of renewable energy in 2019.

Digital procurement marketplaces

- Marketplaces help to accommodate an increasing number of large and small buyers, reducing time and costs associated with trading and reporting procurements.

- The model is gaining momentum in regulated International REC markets. Energy Web Foundation is a non-profit membership-based organization providing an open-source blockchain platform to corporates like PTT (Thai oil and gas company), Foton (Turkish startup), Mercados Eléctricos (energy retailer in El Salvador), SP Group (Singapore Utility), Fohat (Brazilian startup), PJM (U.S. grid operator), and others to launch their own commercial, ledger-based EAC marketplaces.

“The aim for these marketplaces is to ultimately drive the development of new business models to build on the strength of the IREC model,” explains Doug Miller, Marketing Development Manager at the Energy Web Foundation.

- Players are also developing PPA-centric marketplaces in order to link buyers and sellers together in a secure way.

- US-based LevelTen Energy provides a buyer/seller aggregator marketplace to support large and small PPA corporate procurements. For customers who are looking to align their energy load with renewable procurements (see their partnership with Starbucks), the innovator offers a Dynamic Matching product, which uses each buyers’s temporal and locational data to create a PPA portfolio tailored to closely match its load profile. Last month, company launched its first request for proposals in Europe on behalf of a larger corporate purchaser.

“Using temporal and geographic data to procure renewables across a portfolio of aggregated projects can generate energy credits that the buyer needs, that can create a more effective electricity price hedge, and that can create diversification benefits versus a binary single seller model, ” says Jason Tundermann, Vice President of Business Development.

- UK-based Zeigo raised $1 million (GPB 800,000) in seed funding this April, developing a platform that connects energy buyers (private and public sector) and selling.

Market Readiness

Tech giants such as Microsoft and Google are currently leading the way. But, given time, mounting pressure from corporate shareholders and investors (see Blackrock’s plans) to decarbonize will force the mid-market corporates to seriously consider their ESG ratings in parallel with other growth-based metrics and they will start to seriously consider alternative technology pathways.

Opportunity for traceability does not exist solely in the voluntary corporate market. In the compliance market, where utilities are mandated by government to procure/bundle renewable energy, higher quality standards exist for EACs, but they come at the expense of higher admin fees. Traceability innovation can help to create cost efficiencies. Power Ledgers recently partnered with US national exchange, M-RETS and Clearway Group, a renewable developer, for a National REC marketplace which will operate on the compliance market.

Traceability is likely to be an integral part of a fully decarbonized energy system but energy storage and demand-side flexibility is poised to play an equally important role in the next decade. Please see my previous article on the topic published earlier this week.

Physical Locationality is the End Goal

Additionality, tradability and localized procurement will all go some way to supporting a corporate buyer’s claim of emissionality. Ultimately, though, buyers need open local energy market regulations to allow for peer-to-peer energy trading between the renewables they deploy and they electricity they consume. Market regulation and incentive structures need to be introduced to encourage localized behaviour. The UK is leading a pilot on physical location-based energy trading. The TraDER pilot, launched in February, operated by asset marketplace developer Electron, will see a flexibility exchange developed to allow generators to transact directly with flexible assets located throughout the UK.

Keep an Eye on… Traceability’s Role in Electric Vehicles

Electric vehicles (and their owners) will become a dominant portion of renewable energy buyers. Doug Miller, at the Energy Web Foundation recently put out an article outlining how “delivering clean EV charging at scale requires directly linking electricity consumed by EV charging events with an equivalent purchase of an EAC.” Given that EV demand will reach 640 TWh by 2030 (three times more than that required for corporate buyers to hit their current 2030 targets), the industry must be proactive in delivering solutions that ensure all EV charging is supplied with 100% verified renewables—starting with corporate and government EV fleets.