Resilient Food Chains: Innovation for a Safe, Agile, Efficient, Low-Waste Food System

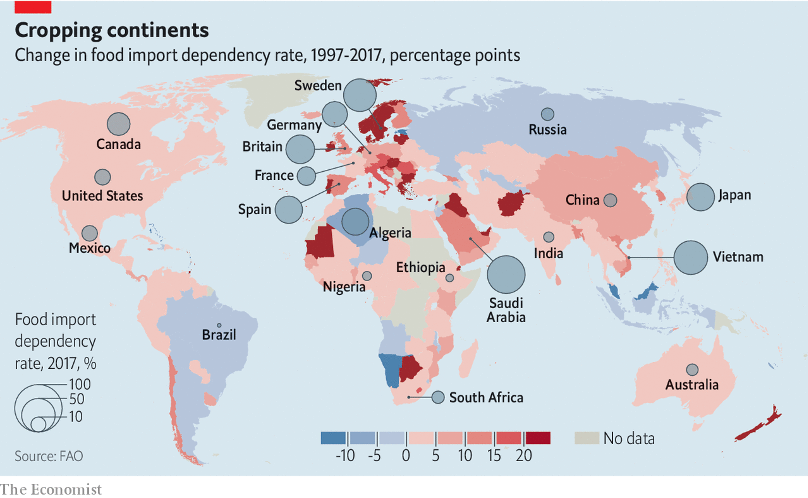

The global food chain accounts for 10% of world GDP and employs approximately 1.5 billion people and Covid-19 is a stress test for this entire system. The worldwide trend has been an increasing reliance on imports, as food exports have grown 600% since 1990. This means 80% of people now rely in part on calories produced in another country. The increasing international trade of food has made the system more resilient to swings in supply and demand.

For a great overview of industry agnostic supply chain technology, take a look at this work from my colleague Cassidy Shell on Resilient Supply Chains and the Technology Behind Them. For a specific look at the challenges and opportunities in the food chain, keep reading here.

Key challenges and opportunities Covid-19 has presented include:

- A global agricultural labor crisis. 250,000 farm laborers from Mexico will not enter the US this year. 90,000 laborers for the UK’s fresh produce market will likely not travel for these jobs.

- Supply chains requiring close quarter working environments, such as meat processing, are being particularly impacted as available labor and acceptable working environments are in short supply.

- With lower prices, some farmers will leave crops to rot rather than harvest. This will reduce planting for the next harvest cycle and will likely affect farms with the thinnest margins and poor access to agricultural insurance first.

- A credit crisis. Small-term loans enable produce supply chains to run while goods move through the system.

- A food service crisis. 30% of calories are eaten out. Adjusting from food service to small and packaged goods for consumer markets is expensive and difficult.

- Pressure on the online grocery delivery industry.

- Food security issues. 19 countries have so far limited exports, affecting 5% of the world’s food supply.

Innovation to increase resilience to food supply chain shocks:

Agricultural Labor and farm automation

Robotics and automation will experience accelerating adoption and usage by farming and food production companies alike. Benefits can include:

- Quality and accuracy of process

- Reduced cycle times and increased productivity

- Improved compliance in industrial systems

- Heightened cleanliness and sanitation

- Reduced crop maintenance and harvesting cycle times

- Operating cost savings.

For innovators such as Naio Technologies, Small Robot Company or Ztractor, there are several revenue stream models, including direct sales of robots to farmers, Robotics-as-a-Service (RaaS) model to deliver and operate robots on site as required, Software-as-a-Service (SaaS) model for online software upgrades for crop analytics and insights derived from the robot’s sensors and machine vision data and aftermarket sales of parts and services.

Incumbents in the farm machinery industry are likely to pull back from funding R&D and innovation initiatives in the short term. Covid-19 will mean less capital availability for machinery upgrades. As a result, competition will be fierce over unit sales. However, this does not diminish the increased demand from farmers for these solutions.

Protein Industry

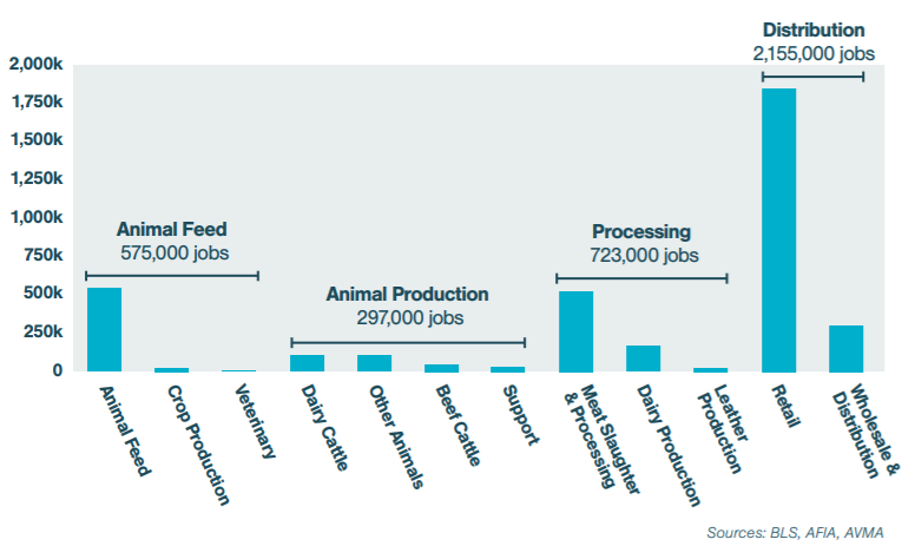

The protein supply chain is also experiencing significant disruption as a result of Covid-19. Firstly, as can be seen from Figure 2, the supply chain step with the third highest employment is meat slaughter and processing. In the US, as it became apparent that these facilities were seeing above-average infections due to working conditions, many large slaughterhouses were closed. Shutdowns cut the country’s pork slaughter capacity by 40%; every five days saw one million “excess” pigs left alive on farms which have no space for them. This resulted in depressed prices for farmers while processors who could operate saw 15-20% increases in profit.

What little innovation there is in livestock processing is dwarfed by the quantity of alternative protein options, and the success they are experiencing during this supply chain disruption. Impossible Foods has shifted its original focus from restaurant and fast-food markets to grocery shelves, where its burgers must compete with rival Beyond Meat’s consumer packaged goods products. You can now buy Impossible Burgers in 1,700 Kroger stores across the US. Similarly, Beyond Meat is accelerating on the back of growing sales, pushing further into China by working with Alibaba’s grocery stores as a sales channel.

Credit crunch in the supply chain

Supply chains run smoothly because short-term loans allow each link to pay for produce before selling it on. As operations slow down, the term of these loans is extended, trapping cash that could be lent elsewhere. Over a fifth of the $425 million in emergency trade cash provided by the Asian Development Bank in April covered food-security deals. ProducePay was set up to alleviate this exact problem in the fresh produce supply chain. It provides next-day payments for up to 80% of the value of a shipment, while waiting for the distributor to pay could take months. This allows for greater financial planning on the farm.

Online grocery delivery

It’s no surprise that online food sales are surging in the wake of Covid-19. While exact figures are changing all the time as methods to control the epidemic are rolled out, one thing is for certain; we have drastically altered our food shopping habits. A recent study claims that online grocery shopping in the US has jumped from 3%-4% to 10%-15% over the last two months. In the UK in March, Ocado, an online grocery delivery service, thought it was being hacked it was so inundated with requests. For brick and mortar retailers to keep up as countries like the UK jump to 20% online grocery sales, backend processes will need to adapt. US-based Takeoff Technologies offers an automated grocery fulfillment solution that lets retailers bolt D2C order fulfilment centers onto an existing logistics infrastructure. Another German-based provider, Fliit, specializes in a platform that connects fresh food shippers with transportation solutions all in one place. The company offers the platform that is needed once Takeoff Technologies has fulfilled the order in-store.

Food Security

While 19 states have so far limited exports, affecting 5% of the world’s food supply, many nations that have food scarcity issues are turning to technology for solutions. The United Arab Emirates recently invested $100 million through the Abu Dhabi Investment Office in four start-ups offering novel farming technology, including indoor farmers AeroFarms and Madar Farms. Kuwait invests $100 million through Wafra, including $10 million for Abu Dhabi based Pure Harvest Smart Farm. Singapore launched the 30×30 express grant program, a $21 million fund to support production of eggs, leafy vegetables, and fish in the shortest time possible to increase their domestic food supply from 5% of consumption to 30% by 2030.

Crop Insurance

A key part of the solution to the current supply chain shock is to increase access to agricultural insurance for the 1.5 billion smallholders who do not have it and are therefore most likely to be catastrophically affected by one lost harvest. Pula is working to bring crop insurance to these farmers. Growing access to good weather, satellite and on-ground data is increasingly making crop insurance more accurate and therefore cheaper and accessible. Digital delivery is more common, so there is no need for appraisal as data collection is accurate enough. Understory is an example of a company leveraging increasingly granular and accessible weather data to improve access to crop insurance.

Keep an Eye on…

There are other opportunities for innovation in agriculture in food that may receive increased investor attention as a result of Covid-19. To name some would include:

- Secondary markets for food waste

- Shelf life extension from packaging and coating innovations

- Food safety testing.

Each of these adding to the flexibility and adaptability of supply chains to cope with shocks, disruptions, and pandemics.