Battery Recycling

From 2023 to 2040, global demand for lithium will grow 870%, 210% for nickel, 390% for graphite, and 220% for cobalt. Due to this surge, we anticipate a parallel growth in the battery recycling industry through several distinct, potentially non-competitive technologies. Battery recycling directly reduces mining demand, especially in markets like the European Union or the U.S. with limited mining or refining of critical minerals like lithium, cobalt, and nickel.

Furthermore, a nickel-rich lithium-ion battery (LIB) made with recycled materials reduces the total greenhouse gas (GHG) footprint by over 28% compared to one manufactured with virgin materials. Thanks to this two-fold promise of domestic critical mineral supplies and reduced environmental footprint, global demand for virgin battery minerals could decrease by up to 30% by 2040.

Large-scale investment began in 2021 from global scrap metal companies and incumbents in mining, chemicals, and automobile manufacturing. Now, a new generation of university spinouts are emerging with process improvements or new recycling techniques to improve material recovery.

Battery Recycling Innovations

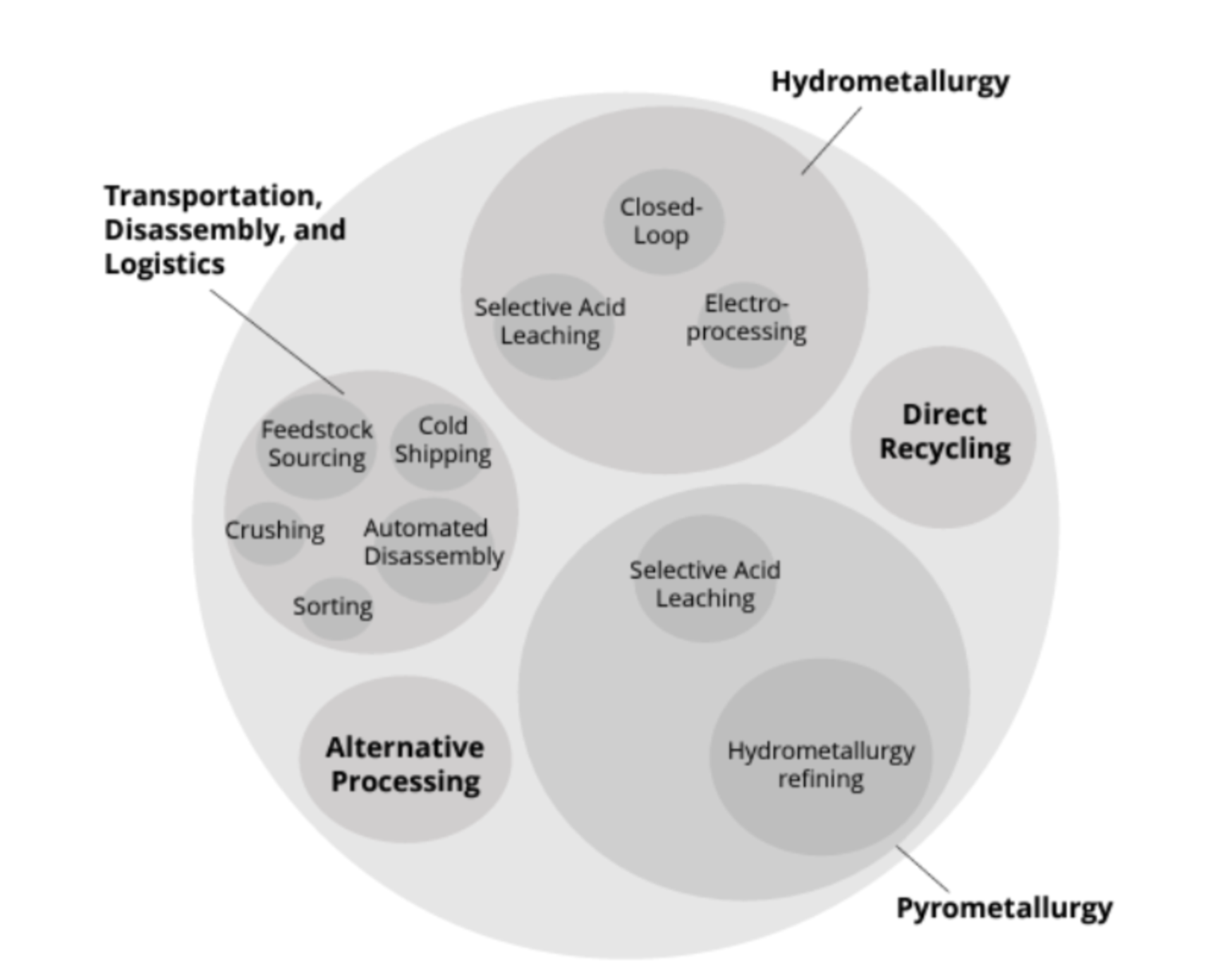

The three primary technologies in battery recycling include direct recycling, hydrometallurgy, and pyrometallurgy. Each type has specific strengths and areas for innovation to improve efficiency:

- Direct Recycling: Physically deconstructing batteries, repairing damages, restoring lost minerals, and reusing the same battery without changes to chemical structure. This technology removes the need for downstream refining in hydrometallurgy and pyrometallurgy. Areas of innovation focus on automation’s impact on profitability in disassembly, sortation, and deconstruction.

Key players include Lohum and Princeton NuEnergy.

- Hydrometallurgy: Use of aqueous chemistry to recover metals from battery materials. Metal salts are then processed and isolated as battery-grade minerals. Hydrometallurgy was historically used as a refining process for pyrometallurgy to improve material yields. Areas of innovation address high chemical/water use, pollution, emissions footprint, and reducing refining steps.

Key players include Ascend Elements and Li-Cycle.

- Pyrometallurgy: High temperature smelting to extract minerals from battery waste. Pyrometallurgy requires the most downstream refining of these three processes and is increasingly incorporating hydrometallurgy for pre-/post-processing. Innovation in pyrometallurgy improves recovery of lithium, reduces emissions.

Key players include Redwood Materials and Sumitomo.

Of these technologies, pyrometallurgy and hydrometallurgy are the most GHG emitting and energy intensive. Hydrometallurgy is generally preferred over pyrometallurgy due to its higher mineral recovery, especially for lithium. Of the three, direct recycling requires the lowest volume of feedstock for break-even profit, recovers the most material, and emits the least.

Direct recycling does require extensive sorting as it can only process one battery chemistry at a time at scale. Over the next 15 years, improved sortation and further Extended Producer Responsibility (EPR) legislation to secure homogeneous feedstocks would bolster direct recycling’s commercial roll-out.

Battery Recycling Innovator Spotlight

- Li Industries: Direct recycler researching economics across battery chemistries but focusing on Lithium Iron Phosphate (LFP). The company’s computer vision and chemical identification sortation software is being deployed at several pilot plants to demonstrate feasibility. Targeting less valuable LFP batteries lowers materials cost while first-to-market sortation solutions drastically reduce labor costs.

- Ascend Elements: Hydrometallurgy recycler producing battery-grade minerals directly from recycling process. Choosing to integrate initial refining steps and target expensive Nickel Manganese Cobalt (NMC) chemistries, the company’s product has emerged as the best quality at highest volume on the market.

- Northvolt: Battery cell manufacturer who integrated hydrometallurgy battery recycling to reduce expenses on mining, refining, and transportation. Purchasing mineral rich production scrap or spent LIBs (S-LIBs) from automobile manufacturers for recycling creates a perfectly circular production process that reduced Northvolt’s emissions by 70%.

Battery Recycling Trends and Long-Term Outlook

Battery recycling received over $8B in investment from 2021-2023. A key reason for this surge was the wild price fluctuations for cobalt, nickel, and lithium. Spill-over effects of these fluctuations hit electric vehicle (EV) manufacturers: reducing output, lowering profits, and stalling or ending planned facility expansions.

Europe and the U.S. are in a precarious market position – poor mineral reserves, non-existent refining, and reliance on China for refined minerals – all leave their expanding EV manufacturing sectors exposed to market instability. Both the EU and U.S. are pursuing an aggressive strategy to import and then recycle batteries, increasing domestic supply of battery minerals for their EV manufacturers.

Each technology has a distinct battery chemistry they target for optimal economic performance:

- Direct recycling, especially in the short-term, should target low volume, low cobalt S-LIBs due to cheaper repair costs and lower competition for feedstocks.

- Hydrometallurgy is suited for high lithium S-LIBs and will be pyrometallurgy’s key rival/increasing complement for large volume processing.

- Pyrometallurgy is best suited for mixed waste with low lithium content, making it a superb choice for difficult to process waste.

After a decade, expect these dynamics to shift favoring direct recycling’s high recovery rates as the industry’s first choice, followed by hydrometallurgical processing of unsorted S-LIBs and pyrometallurgy for consumer electronics or scrap.

Participation in this market is diverse. Chemical companies like Umicore, BASF, and Johnson Matthey leverage expertise to enter hydrometallurgy, scaling recycling plants rapidly alongside start-ups or alone. BHP, Glencore, and EMR also converted their presence in mining and scrap metal into recycling partnerships, standing up several European battery recycling facilities in the last three years.

Battery manufacturers like CATL, Panasonic, and LG lead the recycling industry through their diverse feedstock sourcing networks. These battery manufacturers and automobile OEMs like Tesla and BYD are researching ways to incorporate on-site recycling at their factories, likely through hydrometallurgy or direct recycling. Integrated recycling to EV manufacturing limits offtake partners but creates strong supply chains resistant to global trade issues.

While direct recycling appears to be a long-term winner for its minimal footprint and low energy requirement, chronic sorting issues allow hydrometallurgy to capitalize on this market immediately.