China’s Hydrogen Society Beginning to Take Shape

Last year, we detailed how China’s government had promoted ambitious plans for the development of a hydrogen economy and specifically, how the country’s Science and Technology Minister had expressed a goal of creating a hydrogen society in China.

This year, we are witnessing some of these ambitions bear fruit, as various cities and state-owned companies have launched initiatives which are spurning private sector and multinational investment, as compared to a noticeable absence of private sector involvement in the space this time last year.

Converting the Corporates – Private Companies and Multinationals Buying In

Despite the challenges related to efficiency and innovation that Chinese state-owned enterprises (SOEs) are vulnerable to, one advantage SOEs enjoy in the critical infrastructure sector is the ability to undertake large, experimental, and often risky investments without the same pressure of continuous profitability which private sector actors face.

The wave of investment in hydrogen by China’s SOEs has decreased project risk profiles for hydrogen projects, laying the foundation for the country’s hydrogen economy, with notable investments coming from both China’s private enterprise and multinational corporations.

Ningxia Baofeng Energy Group, a private coal production and processing company, announced in April of this year a start to construction on the world’s largest solar-powered hydrogen plant in Ningxia Hui, northwest China. The plant, which will begin producing hydrogen by 2021, will consist of two 10,000m3/hr electrolyzers powered by two 100 MW solar plants plus a 1,000kg/day hydrogenation station, producing 160 million cubic meters of hydrogen annually.

In late 2019, Air Liquide partnered with Sinopec to open two hydrogen refueling stations in Shanghai, with the ability to serve 200 hydrogen fuel cell buses operating in the area. This came just a few months after Air Liquide formed a special purpose joint venture with Chinese company Huopu in mid-2019 to open the first hydrogen refueling station in Zhejiang province. The Air Liquide-Huopu joint venture has also committed to delivering a hydrogen refueling station in Beijing as a part of the infrastructure for the 2022 Olympic Games.

Racing Toward 2022 – Hydrogen as a Keystone of the Beijing Winter Olympics

Laying the groundwork for a green Beijing Olympic Games in 2022, the city government has set a target of having 1,000 fuel cell buses operating by the time the games commence. Sinopec has agreed to construct 10 hydrogen refueling stations in one of the Games’ competition zones, Zhangjiakou, to support the hydrogen buses serving attendees. Further evidence of the ways in which SOEs are leveraging private sector partnerships to achieve goals is the series of Memorandums of Understanding (MoUs) that government-owned China Power has inked with multinational technology companies.

In late August, Siemens arrived at a deal with China Power to provide a hydrogen production system in the Yanquing District of Beijing, one of the three competition areas for the 2022 Olympic Games.

Irish-headquartered industrial processes and specialty gases company Linde signed an MoU with a subsidiary of China Power in July to implement hydrogen mobility solutions for the 2022 Olympics in Beijing.

New Energy Vehicles Still a Hotbed of Entrepreneurship

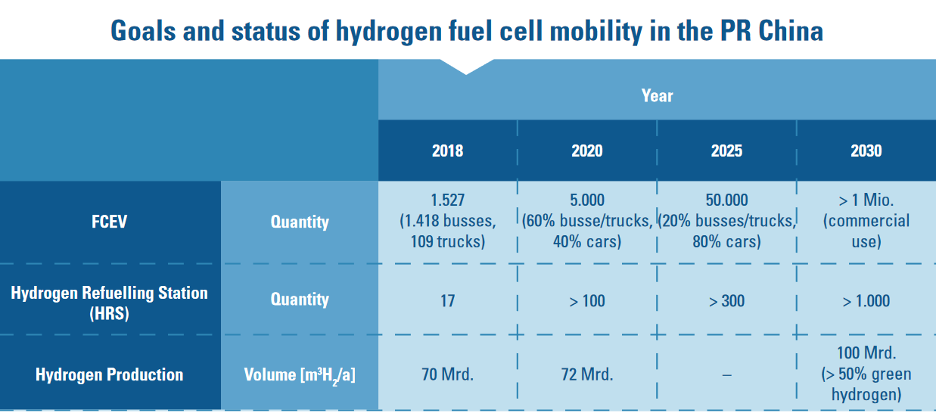

The government continues to promote ambitious targets for increased roll-out of Fuel Cell Electric Vehicles (FCEVs), aiming to have over 1 million on the road by 2030, accompanied by 1,000 hydrogen refueling stations (HRSs).

The dynamism of China’s electric vehicle market is due in large part to the participation of start-ups utilizing unique business models to compete against incumbents, such as Nio’s battery-swapping stations and Li Auto’s vertically-integrated manufacturing process (versus Nio, who outsources production). Achieving the government’s targets for FCEVs on the road will partially be a function of how well the country’s entrepreneurs fair in innovating their way into the space.

- Re-Fire, a Shanghai-based producer of fuel cells for heavy-duty vehicles cooperated with Toyota this year to bring 20 fuel cell buses into operation in Changshu, and has won contracts with Toyota and Mitsubishi Fuso to develop heavy-duty vehicles.

- Beijing’s SynoHytec provided fuel cells to ZEV Chengdu Automobile for 20 hydrogen buses that were deployed in Longquanyi District, Chengdu, in mid-2019.

NOW GmbH (National Organisation Hydrogen and Fuel Cell Technology), 2020

New Entrants: A Case in an Emerging District’s Journey to Become a National Center of Hydrogen Innovation

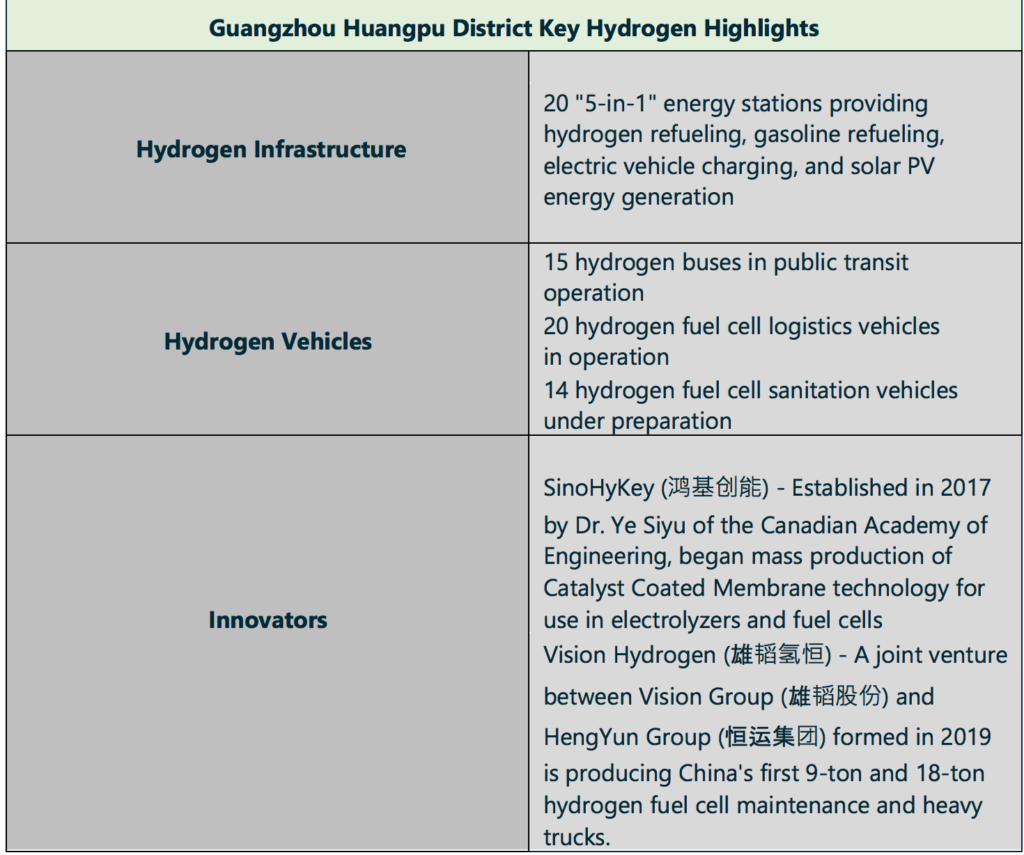

Situated along the ZhuJiang (Pearl) River in China’s fourth-largest city of GuangZhou is HuangPu District, an emerging industrial district with a population of 880,000, that has quickly built a reputation for fast implementation of hydrogen technologies. The district has used a policy mix of company registration incentives, capital expenditure alleviation, and a 5 billion Yuan venture fund to attract new companies and projects to the district. Perhaps more importantly, the district leveraged advantages in local hydrogen resources (industrial hydrogen by-products, wastewater for electrolysis, chemical production facilities) and infrastructure laid by a local automotive manufacturing and assembly industry to create a hydrogen industrial base predicted to be valued at 20 billion Yuan by 2025 and 100 billion Yuan by 2030.

Over 20 hydrogen start-ups have been launched in the district as a result of the district’s policies and the opportunities to engage public procurement of hydrogen technology. The district plans to construct an international hydrogen industrial park to serve the wider hydrogen industry in Guangzhou, to accelerate innovation in fuel cells, hydrogen refueling, and energy storage with hydrogen, supported by participation from Sinopec, CIMC, and China Southern Power Grid.

Keep an Eye on…

Coal gasification remains the greatest potential source of hydrogen production in China; however, production of truly green hydrogen requires a comprehensive system of carbon capture, use, and storage that many facilities are not prepared to bear CAPEX burdens for. China’s mass deployment of solar and wind projects in the past two decades offers a unique path forward – many renewable assets were deployed without a reliable connection to a grid and many of the wind and solar technologies deployed are inefficient. This leaves an opportunity open to convert potentially stranded renewable assets into local producers of hydrogen for energy storage. Additionally, China is likely to see a boost to targets for wind and solar energy, with National People’s Congress recommending a minimum of 150GW wind capacity and 300GW solar capacity for inclusion in the upcoming 14th Five Year Plan.

The 14th Five Year Plan (2021-2025), set to be released in October, is likely to lay out more concrete measures for hydrogen and FCEVs to move China further toward energy independence. The current Five Year Plan mentions the importance of hydrogen at a macroeconomic level and public funding for new energy vehicles under the “Financial Support Policy for New Energy Vehicles 2016-2020” incentivized investment in FCEVs through the end of 2020. Subsidies under this program will now be extended through 2022 (excluding vehicles with swappable batteries and those costing over $42,863) and will be reduced by 20% in 2021 and 30% in 2022.

However, the global recession and sustained fallout over trade with the United States are likely to place increased pressure on hydrogen to play a meaningful role in the country’s next phase of development and motivate further public investment and incentives for actors in the sector.