Energy Retail Innovation: Opportunities to Improve Consumer Engagement

Energy Retail Innovation: Opportunities for Better Consumer Engagement

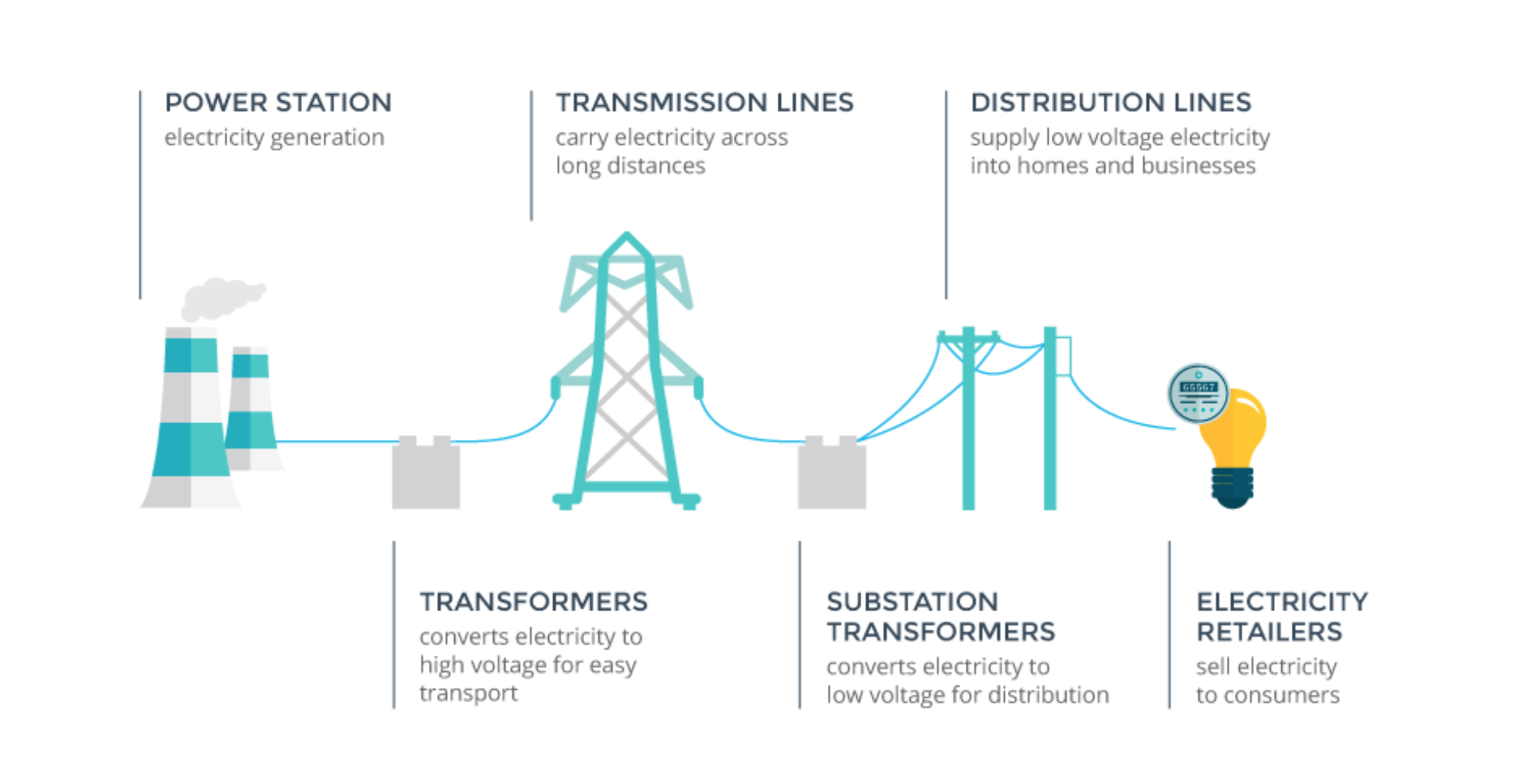

Electricity retailing, the fourth and final stage in the electricity delivering process. is a model ripe for innovation in 2020. Numerous opportunities are being created, ranging from upstream energy to integrating downstream to offering new advanced services and technologies.

Figure 1 Electricity market, courtesy of BlueNRG

Figure 1 Electricity market, courtesy of BlueNRG

The business function, which involves the sale of electricity to the end user, initially emerged in the 1990s as markets were deregulated and national monopolies were broken to drive competition. Today, small and medium alternative retail players are abundant. The United Kingdom, which went through deregulation in the 1990s, has over 70 energy suppliers, including Octopus Energy, Bulb, OVO Energy and Shell Energy. These players have taken up considerable market share from the largest suppliers -which dropped from nearly 100% to 73% between 2011 and 2020.

Japan’s electricity market is undergoing a gradual deregulation and unbundling process. Hundreds of new electricity businesses have been set up in anticipation of increased customer fluidity. A customer in Japan can now choose between around 200 companies offering plans.

Despite how good the technology may be, disengaged energy consumers who are not willing to pay extra for marginal cost and energy savings remains one of the core challenges for many emerging players in residential energy market. Retail, and other customer facing services, can offer a pathway for technology producers to address this key cost concern through smart financing packages. These technological changes are opening new opportunities for the energy retail market. The model will be used by start-ups and corporates to deploy energy new services and technologies, and emerging technology providers are capitalizing on existing routes into the homes and businesses.

Innovator models:

Currently, the main drivers of customers switching to an alternative energy supplier has been lower price and better customer service. The plan is to offer tariffs which integrate EV charging, storage and demand side response opportunities in partnership with emerging technology providers at competitive price points, thereby increasing the domestic market. Meeting these consumer needs and unlocking the door to disengaged energy consumers is the real opportunity.

Founded in 2015, Octopus Energy is one of the UK’s fastest growing alternative energy retailers. The company has acquired over 1.5 million domestic and business customers through a handful of big market acquisitions, including Iresa, Affect Energy, M&S Energy, Co-op Energy, 4hundred and most recently, Engie Residential Energy Supply UK. After the acquisition of nCube in late 2019, the company launched its Kraken technology platform, to let third parties (including utilities) take advantage of the technologies developed internally and externally via partners such as Tesla Energy, Char.gy and Ohme. This May, the company raised $507 million from Australian energy company Origin Energy, which acquired a 20% stake. The deal will allow Octopus Energy to expand in the global markets, initially targeting Australia and the Germany. With the technology first approach, the alternative energy retailer is well posited to offer advanced service offerings to markets which remain less equipped.

The US market has more complexity, with both vertically integrated and wholesale markets. States can have either regulated or deregulated (i.e., competitive) retail electricity markets. US-based Arcadia has raised over $60 million in equity funding to disrupt the energy supplier market via a direct-to-consumer platform. The company operates a nationwide digital utility that connects everyone to clean energy and energy efficiency choices. Members have access to a mobile-optimized online dashboard where they can:

- Enroll in clean energy programs (Wind Energy, Community Solar, Price Alerts, Home Efficiency, Bill Pay)

- Track their account activity

- View their energy usage.

Corporates moving downstream:

Global corporates are also capitalizing on the energy retail market. Japanese conglomerates, for example, are using the model to establish themselves in the distributed energy market as they look to move further downstream.

Itochu, a major Japanese corporation which has sold over 330MWh of residential battery storage systems in its home market, recently invested $9.35 million in TRENDE, a renewable energy retailer which counts utility Tokyo Electric Power among its shareholders, with a view to launching a range of renewable energy and storage-enabled services. Through the investment into TRENDE, the corporate is launching a co-operative business model including renewable retail, manufacturing of distributed energy products, delivering virtual power plants and ancillary services using energy storage systems. The pair plan to include no-money-down business models and leverage their technologies and customer base to increase Japan’s share of renewable energy.

Itochu is currently involved upstream, in metals and minerals, but relies on partners such as LG Chem and Samsung SDI to make batteries, before the group assembles complete systems. In the co-operative model, the battery systems are controlled and optimized using Gridshare, an AI software platform developed by UK energy storage company Moixa (Tokyo Electric was an investor before the Itochu partnership). The image below shows how the new model will function.

In a similar fashion, a major Japanese corporation Mitsui invested in UK-based energy retailer Tonik Energy back in 2019, as the group expanded its global downstream business and services in the gas and power sector. Tonik offers the group the opportunity to offer value-added integrated services including distributed generation and EV charger solutions. Mitsui is using Tonik as a pilot to see how similar investment models can work globally across other markets.

Many oil and gas players are also retreating from IPP positions and looking at the alternative energy retail market as a way to offer move downstream and offer a new business model capitalizing on the convergence of energy efficiency, and distributed energy resources.

Back in 2018, Shell acquired alternative energy retailer First Utility, which it has since rebranded to Shell Energy in 2019. Shell Energy offers competitive green tariffs and value-add services to UK residential customers, businesses, and housebuilders. In the big picture, the business is a way for Shell to become integrated downstream and to further expand their efforts in the residential distributed energy resources market, following the acquisition of Sonnen in 2019. In July, Shell Energy launched a Solar Storage tariff as part of its partnership with Sonnen where customers with solar panels will be able to earn solar credits when they are generating excess power whichcan be exported to the grid.

For players such as Shell, Mitsui and ITOCHU, which do not have a not past interface with the end consumer, energy retail is a powerful tool in which they can control the introduction of new services into the market.

Keep an eye out for…

- Consumer facing models such as energy retail are a ripe testing ground for peer-to-peer pilots in deregulated markets. Players such as Power Ledger, TRENDE and Greensync have multiple active pilots.

- Players working in energy disaggregation have an opportunity to gather consumer data from customers in regulated markets.

- Opportunity to test transactive energy in real settings (Power Ledger and TRENDE).

- Regulatory headwinds, increasing competition, growth in renewables and investors leading to further retail power market consolidation in markets such as the UK and Japan.

- Stringent entry requirements for new suppliers including tighter funding requirements restricting new entry into the market.