EV Batteries: Creating a Circular Economy

In 2018, the total global stock of electric vehicles in all classes stood at nearly 6 million. By 2030, the International Energy Agency (IEA) estimates this number will have reached between 130-250 million. The need to electrify transportation is essential if we are to meet the goals outlined by the Paris Agreement because EV vehicles could potentially reduce well-to-wheel GHG emissions by half compared to vehicles powered by internal combustion engines.

However, challenges loom. Lithium-ion batteries are the key component of electric vehicles and scaling up production of EVs will increase demand for critical materials contained in lithium-ion battery cathodes, mainly cobalt, lithium, manganese and nickel. If disposed of in landfills, used lithium-ion batteries pose a significant environmental hazard and the remaining storage capacity and rare earth metals contained in the batteries are wasted.

Although estimates of EV adoption vary widely, certain transportation segments -such as transit buses and school buses- are electrifying rapidly. The lifespan of buses is approximately 12 years but constant operations exhaust the batteries faster than those used in personal vehicles. As a result, rapid uptake of the large batteries needed in this segment will accelerate the need for better solutions to manage their disposal as they come out of use over the next decade.

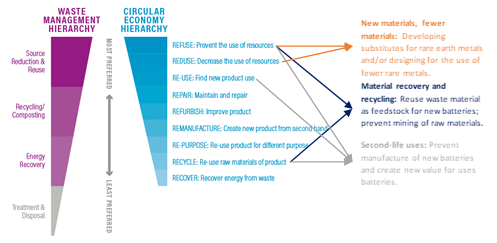

Circular Economy Model

On the bright side, the waste challenge posed by EV batteries combined with the rapidly increasing demand for raw materials creates a significant opportunity to develop a circular economy. The following figure outlines the necessary business activities and their importance in creating a circular economy. Applying this framework to EV batteries, the top priorities will be preventing and decreasing the use of resources (particularly rare earth metals) and finding new uses for batteries removed from electric vehicles.

Drivers

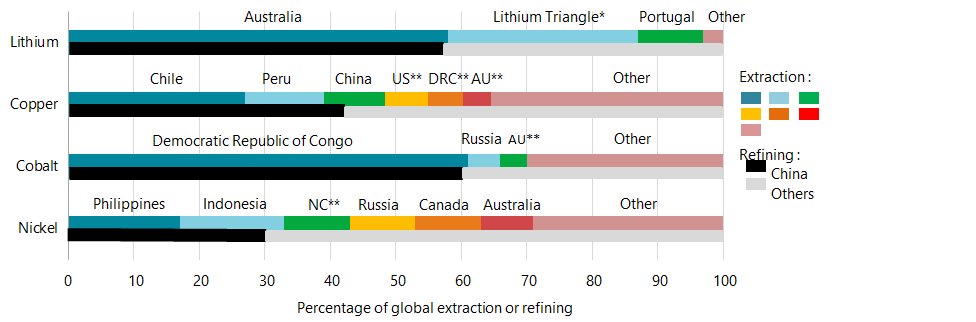

Demand for raw materials

By 2040, the global demand for electric vehicles is projected to reach 900 million units. Accelerating EV uptake will only increase demand for raw materials in the sector. The extraction of lithium and cobalt is highly concentrated geographically in Australia and The Democratic Republic of Congo, respectively, but nearly 60% of their refining takes place in China. Reducing the volume of raw material extraction will be crucial to preventing shortages and higher prices, as well as decreasing dependence on a geographically concentrated supply.

Government mandates

Government mandates in the EU and Asia are creating policies around recovery and recycling of lithium-ion vehicle batteries, including producer responsibility for end-of-life batteries. In 2019, the California EPA formed the Lithium-Ion Battery Recycling Advisory Group in response to Assembly Bill 2832 to steer policies around EV battery recycling. In September 2018, Beijing issued a set of industry guidelines for EV battery recycling in a first effort to support a recycling industry in the country. China’s growing EV industry is largely dependent on imported raw materials with increasing and volatile prices so battery manufacturers there see building a robust recycling industry as an opportunity to reduce both material imports and prices.

Innovations for a Circular Economy

New materials, fewer materials

In a joint venture with LG Chem, General Motors has developed an Ultium battery that features a low-cobalt chemistry. Tesla and Dalhouse University are developing a battery that uses a lithium nickel manganese cobalt oxide (NMC) structure for the cathode to improve efficiency and reduce wear and tear on the battery. In addition, Reuters reported in February that Tesla is in talks with CATL to source cobalt-free batteries for Tesla’s Chinese-made vehicles. IBM is developing heavy metal-free batteries using three novel and proprietary, as yet undisclosed, materials. In February, SPARKZ, an electrochemical energy storage startup, licensed five battery technologies from the U.S. Department of Energy’s Oak Ridge National Laboratory that include cobalt-free cathode materials, a new electrolyte formula and processes to scale to commercial production.

Material recovery and recycling

Umicore is one of the leading EV battery recyclers, using a hydrometallurgical process to chemically break down battery materials into feedstock for new batteries. The company is processing batteries mainly from wrecked vehicles and delivering recovered materials to battery manufacturers for use in new batteries. OEMs maintain ownership of the materials throughout the process and can purchase batteries with their own materials from manufacturers. In December 2019, Audi and Umicore completed the test phase of their strategic research cooperation and found 90% of the cobalt and nickel in the Audi e-tron’s batteries can be recovered. The next phase of this partnership will involve developing a closed-loop process to use recovered cobalt and nickel in new batteries.

American Manganese has developed a proprietary hydrometallurgical recycling process that can achieve 100% purity of recovered materials. In 2019, the company moved from lab testing to operating a pilot plant to generate learnings for scaling up and de-risk the process. American Manganese is targeting battery manufacturers as initial customers for commercial operations, as at least 10% of the raw materials used to manufacture batteries are wasted in the process. The tailings created in shaping raw materials into batteries are low-hanging fruit and easier to recycle than entire batteries, which need to be transported and disassembled before recycling can take place. The company hopes to scale by implementing their recycling technology into manufacturing facilities and then expanding into full battery manufacturing once the technology is proven at commercial scale.

In March 2020, Fortum, BASF and Nornickel signed a letter of intent to develop a li-ion battery recycling cluster in Finland. Recovered battery materials will be used as feedstock in BASF’s planned li-ion materials precursor plant in the same area, creating a closed-loop system. The DeMoBat project in Germany is developing an EV traction battery and an electric motor dismantling system using robots. Currently, dismantling batteries is done manually through a time and labor-intensive process.

Second-life uses

The lithium-ion batteries contained in vehicles are designed for approximately 10 years of useful life to accommodate the demanding needs of vehicles. However, these batteries still contain at least 70% of their total capacity and up to 10 additional years of operation after they’re no longer fit for vehicles, making them prime candidates for stationary applications. Electric vehicles sold through 2020 could provide between 120 and 549 GWh in energy storage capacity by 2028 – representing a significant amount of storage capacity that is both cost-effective and more environmentally-friendly than lead-acid batteries. Many companies such as Groupe Renault, Nissan and Toyota are testing the economic and operational viability of different applications.

Nissan has been working in the space for a decade now with activities including:

• Creating a joint venture, called 4R Energy, with Sumitomo in 2010 to repurpose electric vehicle batteries.

• In 2014, 4R Energy developed and installed a 600kW system made from Nissan Leaf batteries at a 10MW solar farm in Japan.

• In the US, Green Charge Networks has used second-life Leaf batteries in commercial-scale energy storage systems.

• Most recently, Nissan partnered with EDF Energy to test the use of second-life batteries to support on-site generation and demand management and create additional revenue streams.

Groupe Renault, The Mobility House, Mitsui and Daimler have set up a joint company in Germany to build a 20MW battery storage project using 2,000 second-life EV batteries. The capacity will be used as load management and backup power.

In 2018, Toyota announced a partnership with Chubu Electric Power to build a large-scale battery storage system that reuses end-of-life batteries from Toyota electric vehicles. Chubu will be able to use the 10,000 kW storage capacity to even out imbalances in supply and demand on the grid. In addition, the two companies will explore ways to eventually recycle the batteries. Toyota has partnered with Seven-Eleven Japan on a project that will incorporate energy storage systems (developed from second-life EV batteries) with fuel cell generators, renewable energy and energy management systems to provide low-emission electricity for convenient stores.

Beeplanet Factory, a company founded in 2018 that develops 4-12kWh stationary energy storage systems from end-of-life EV batteries, recently became the first Spanish startup to be accepted into InnoEnergy’s Highway program. The company works with OEMs to collect batteries and has found an end market with energy companies that are looking for sustainable distributed energy storage systems. For auto OEMs, Beeplanet provides an additional value stream for end-of-life batteries, which OEMs would typically have had to discard at a cost. So far, the company has focused on building out the technology and business model to reliably provide services; the company also plans to develop additional capabilities, such as cloud monitoring of batteries and larger systems up to 200kWh.

Keep an Eye on…

Electric vehicles still only account for less than 0.5% of the global vehicle fleet and the number of batteries coming out of use in vehicles is small. However, these numbers will increase significantly in the next decade and beyond, allowing both the market, as well as recycling and reuse technologies, to mature. Solutions for OEMs in high-growth segments, such as electric buses and fleets, will provide near-term opportunities to commercialize recycling technology and develop larger-scale second-life applications.

Looking for the latest insight and innovation in Cleantech?

Join us for Cleantech Forum Europe on 12-14 January.