Food Redistribution : What Can We Do About Wasting Over 30% of All Grown Food?

The headline numbers in food waste are depressing reading. One-third of all food grown is not eaten. Food we waste consumes 20% of all freshwater, fertilizer, cropland, and landfill volume (in the US at least).

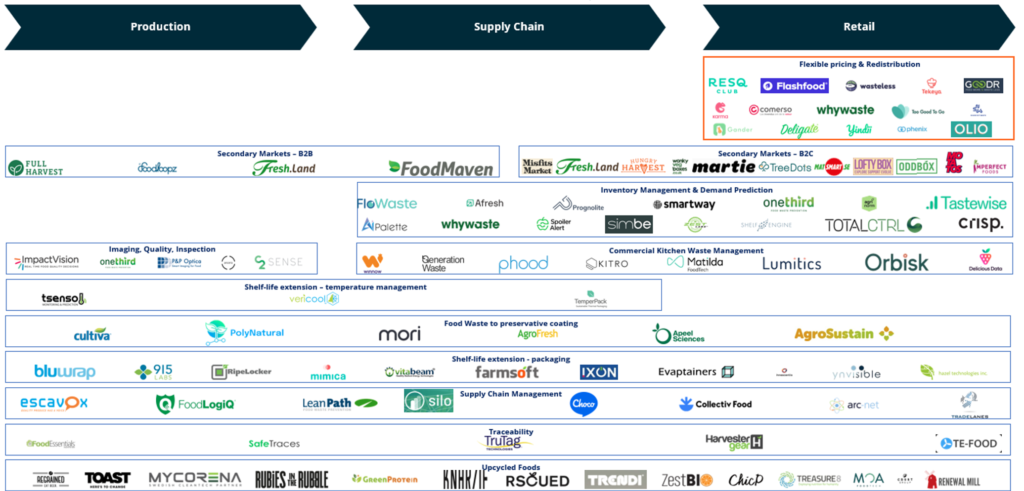

This is a sector ripe for innovative solutions. As we have covered before, preventative solutions are the most impactful at reducing food waste and associated resource use. Food redistribution comes next on the hierarchy of solutions, with business models increasingly moving away from non-profit donation and into profitable enterprise services and consumer-facing solutions.

These solutions are attractive to food service and retailers

Firstly, many countries offer corporate tax credits on donated and diverted food waste to support charitable giving. This varies from 60% of net book value in France to 140% of value in Portugal (capped at 0.008% of turnover). Redistribution models also offer food companies reduction of losses on existing products. Redistribution models can generate new revenue streams and product lines by repurposing existing products. Redistribution models contribute to food waste/loss and sustainability targets.

There are three key takeaways on business model innovation

- Food redistribution start-ups are moving from non-profit to profitable business models.

- Business models are transforming from commission and success fee-based to subscription models for services such as real time pricing, inventory management, and delivery.

- Start-ups looking to capture value are integrating with upstream activities such as inventory management systems to prevent and redistribute waste as-a-service.

Competition is growing as service offerings broaden

The industry is moving away from commission-based secondary marketplaces and towards subscription and contracting. For example. Phenix now provides its service as a subscription-based model, moving away from a commission-based model based on transaction and quantity of waste diverted.

Redistribution-focused start-ups are offering redistribution services as part of a wider inventory management service, which competes with established service providers in the supply chain such as Spoiler Alert.

Business models are looking for profitability beyond giving customers access to distribution/donation-based corporate tax credits.

Partnerships with large food retailers are increasingly leveraged to grow redistribution networks.

Expanding redistribution networks will occur through industry partnerships (Too Good To Go/Olio) and acquisition (Phenix acquiring My Foody).

Consumers are supportive of food donation and improved food labelling solutions, with one study showing 90% of US consumers supportive of these solutions and 80% agreeing that they were effective. However, cost of living is set to increase globally and reduce consumer’s willingness to pay for food waste solutions. Research also shows that the majority of consumers assume a ‘polluter pays’ tax on food waste would likely increase cost for consumers.

There is a gap between target setting and action

Large food and restaurant corporations across the board are making commitments to reduce food waste. Typically, they are aligning with the UN Sustainable Development Goal of reducing food waste 50% by 2030. However, activity to bring in innovative business models has been muted. Kroger have committed only a $2.5 million fund through its Zero Hunger Zero Waste campaign to invest in start-ups across the entire food waste value chain. Tesco have partnered with Olio and are looking to expand their commitment. There is evidence that start-ups are finding customers for solutions that integrate with inventory management, real-time pricing, and redistribution, but there is little evidence of more direct support of innovation.

Keep an eye on…

Start-ups increasing the breadth of service offerings to increase supply chain integration. This will create more ‘sticky’ customer engagement as well as provide optimization through tracking supply chain data further upstream. Keep an eye out for further redistribution network expansion through acquisitions.