Nature-Based Carbon Offsets – New Insight From Cleantech Forum Europe

To assess the growing nature-based carbon offsets market in light of criticisms, transformative technologies and opportunities, we invited Marianne Tikkanen, Co-Founder of Puro.Earth; Jim Mann, CEO & Co-Founder of The Future Forest Company and Fredrik Ekstrom, President of Nasdaq Stockholm to Cleantech Forum Europe.

We began by outlining three key questions:

- Why now?

- Can offsets really make an impact on climate change?

- Are offsets a good idea?

Both the voluntary and compliance carbon markets have existed for some time. Why are they seeing a resurgence?

- Demand is growing as corporates aim to reduce emissions and act on recent sustainability goals.

- Technologies to produce projects and verify their existence are smarter, reducing the overall costs of producing an offset while ensuring valid and transparent market participation. These tools are automating project monitoring and verification by combining technologies such as LiDAR, computer vision and satellite imagery, cloud computing, AI and blockchain-based software.

Can offsets really make an impact on climate change?

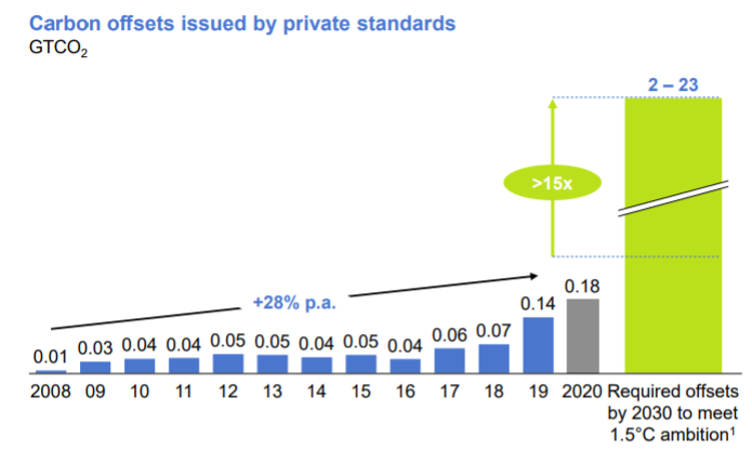

According to The Taskforce on Scaling the Voluntary Carbon Markets (TSVCM), If the Voluntary Carbon Market (VCM) scaled 15x by 2030, it can achieve the 23 GTCO2 of carbon removal required to get us back on track for a 1.5-degree world.

Are offsets a good idea?

The market has faced bad press for good reasons. Through speaking to key market players in the VCM, we’ve found four key reasons:

- Measuring carbon sequestered in natural systems is difficult or methodologies don’t exist.

- Some sectors, especially the land-use, land-use change, and forestry sectors, have enabled over-crediting leading to a lack of market trust and a drive for transparency.

- Ensuring permanence and preventing leakage (ensuring carbon is where you said it would be stored for how long you said it would be there) is difficult as land protection needs to be monitored over its lifetime.

- Proving a project wouldn’t have happened without offset funding, or proving additionality didn’t occur is difficult to prove.

The speakers who joined the Nature-Based Carbon Offset session were all working to address one or all of the above challenges. Marianne Tikkanen, Co-Founder of Puro.Earth explained how a marketplace for high-quality, verified offsets, like Puro.Earth is developing, can ensure market trust and transparency,

“…in simple terms, we build trust. Looking first at the registry and standards role which Puro.Earth has, everything is already registered to make sure credits are only used once. Methodologies are public, audit statements are public, and these are also linked to public retirement information. On the marketplace side, project producers and buyers have access to online shop capabilities. This is a good trust building exercise as it enables benchmarking of market prices. In addition, with the multi-year offtake agreements, project producers can see that the market will be there for years to come and can trust building their business in this market.”

Jim Mann is CEO & Co-Founder of the Future Forest Company. The company produces reforestation and afforestation projects combined with enhanced weathering Jim explained the challenges for innovative project producers to measure and monitor carbon sequestration in natural systems,

“With enhanced weathering you must be very careful about your lifecycle analysis.It was always thought the energy needed to grind the rock would take-away any carbon sequestration benefits it could deliver. However, the science has shown that’s not the case and there is huge potential. Still, it’s very hard to measure. In an open environment you have products produced which are washed off in the water system, so you are trying to measure things that are escaping. Whereas, compared to, say, biochar, you can see the carbon you have sequestered; you can weigh it. Enhanced weathering products are often taken away into the ocean, but we are working on developing those methodologies at the moment.”

Fredrik Ekstrom, President of Nasdaq Stockholm spoke about how Nasdaq can help grow the voluntary carbon market following their purchase of a majority stake in Puro.Earth:

“Firstly, we are helping to come up with robust methodologies for new removal solutions. Then we can support one of the biggest challenges in this market and that’s allocating capital. There are all these new and innovative projects which need project finance to build and scale that must come both from private and public funding. Nasdaq has knowledge and experience on how best to allocate capital, and we have started to support Puro.Earth on this. Another element is how you build a market, which we have experience with. We are helping to build an efficient and transparent voluntary carbon market.”

So what’s next for the Voluntary Carbon Market?

Multiple intermediary actors, like the TSVCM, are forming consortiums to create a formal, centralized, voluntary carbon market and the ancillary market infrastructure. This infrastructure includes:

- Governance

- Standardized legal framework for credit liability and ownership

- Minimum standards for credit integrity

- Access to finance and insurance.

Innovators and incumbents, like those showcased in this session, continue to develop technologies and methodologies to iron the creases out of the VCM. If demand from buyers continues it’s likely the VCM could scale 15x by 2030 to achieve the 23 GTCO2 of carbon removal required to get us back on-track for a 1.5-degree world.