Taking A Byte of Transparency: The Tech Behind Agri-Food Traceability

As consumers demand more transparency around the safety and sustainability of the food they consume, governments are responding with stricter rules. A flurry of recent regulation, including the U.S. Food Safety Modernization Act (FSMA) and the EU Deforestation Regulation (EUDR), is pushing agri-food producers to implement more robust traceability systems.

To achieve this, they are turning to cutting-edge technologies. By tracking the journey of agri-food products across the supply chain, traceability technologies are improving visibility and accountability, ensuring that the food on our plates is safe, ethically sourced, and environmentally sustainable.

The Impact of Food Fraud and Waste

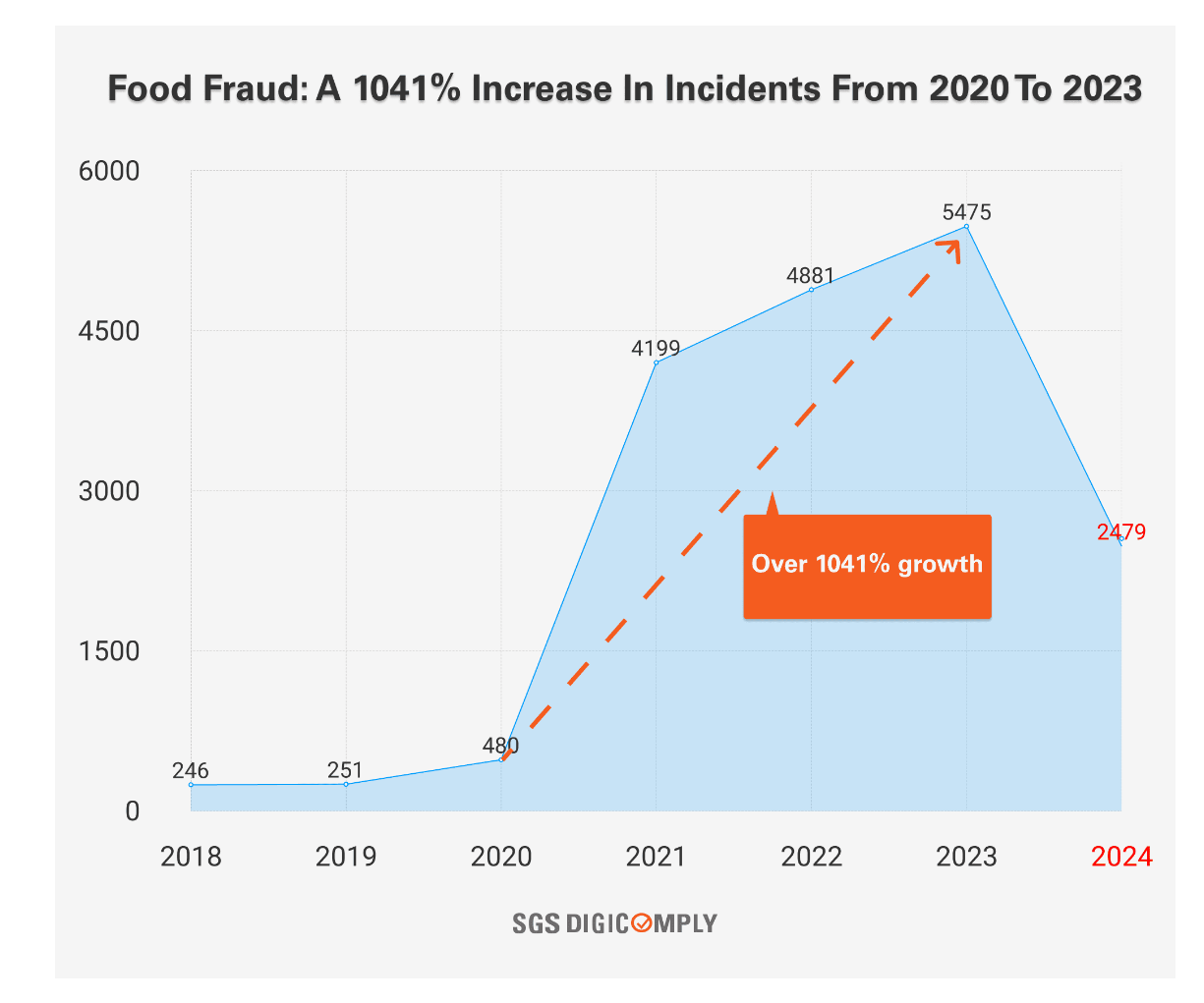

Food fraud has surged since 2020, driven largely by supply chain disruptions related to the Covid-19 pandemic. Fraudulent activities such as mislabeling have risen as some supply chain actors attempt to meet demand and cut costs.

One example is the U.S. seafood market, where up to 40% of shrimp is mislabeled. This lack of transparency can contribute to significant food waste, as consumers discard 30% of fresh food annually due to concerns about quality.

Food Fraud: A 1041% Increase In Incidents From 2020 to 2023

The UN Food Waste Index estimates that food waste costs the global economy approximately $1T each year and contributes 6-8% of total greenhouse gas emissions. Improving traceability could add $600B in profits to the global seafood industry by curbing illegal, unreported, and unregulated fishing, and reducing food waste.

Food Traceability Tech in Today’s Supply Chains

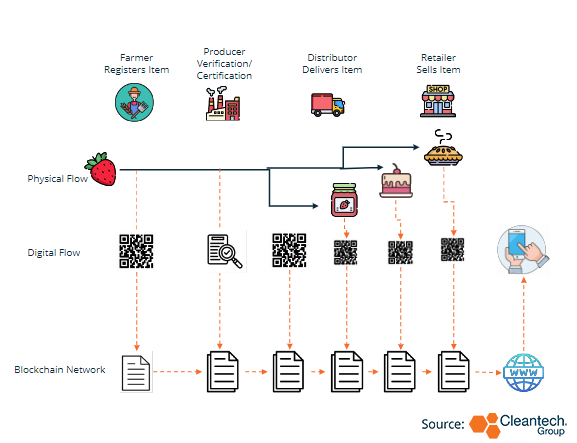

Food traceability involves capturing detailed data on the production, processing, handling, storage, and distribution of agri-food products. By assigning unique identifiers to each food product or ingredient, companies can trace their movement throughout the supply chain. This process enhances transparency, reduces waste, and combats food fraud.

Tracing Food Provenance Using QR Codes & DLT

Relevant information such as location, temperature, and handling practicesare often stored in cloud-based traceability systems.

These systems, especially for temperature-sensitive products like seafood and dairy, can reduce spoilage by as much as 40% and achieve further benefits such as decreased emissions due to optimized logistics and resource management.

Incumbents and Innovation

Technologies like blockchain, alongside cloud computing and IoT, are becoming more prevalent. Incumbents like IBM, Walmart, and Nestlé dominate the market, but innovators offering specialized, or niche services, can still carve out a place for themselves.

For example, Darwin Evolution specifically caters to Latin American producers exporting to the U.S., showcasing the opportunity for growing innovators to find a foothold in targeted regions.

Although established technologies such as blockchain have seen widespread adoption, there remains potential for growth in emerging areas like biotags.

Biotags, which use biochemical markers on food items, cater to niche markets like those for organic and non-GMO produce. Companies like Natural Trace are pioneering biotag solutions to ensure the authenticity of high-value food products. Beyond the food industry, innovators like TraceChain and Oritain are also distinguishing themselves by extending traceability solutions into sectors such as apparel and consumer electronics.

Navigating the Path Forward

Validation and pilot projects remain critical for start-ups to gain traction in this market. Innovators who can demonstrate tangible return on investment (ROI) for agri-food producers and distributors, by improving operational efficiency, reducing waste, and enhancing safety, will be well-positioned to succeed.

Furthermore, interoperability and standards compliance are key to scaling these innovations. Solutions that can integrate with existing supply chain systems and adhere to global data standards, such as GS1 and the Global Dialogue on Seafood Traceability (GDST), will be preferred by larger operators. Partnerships with key players in the food and agriculture sectors are also crucial for start-ups seeking to scale, as seen in collaborations like iFoodDS with IBM Food Trust.

Keep a look out for…

- Growing demand for sustainable protein sources: Rise of alternative proteins, including plant-based, cell-cultured meat, and insect-based products, is reshaping the food industry – as demand for these novel foods grows, traceability becomes critical to ensure that they meet safety and ethical standards, particularly in supply chains where novel inputs are less familiar

- Sustainability-driven policies: Policies around carbon emissions, food waste reduction, and sustainable agriculture are increasingly tied to traceability requirements – as more of these come into play globally, innovators have an advantage in scaling, e.g., the EUDR is likely to drive scaling of traceability tech in the Latin American market due to co-dependance as trading partners for key agri-food products from the Amazon region

- Food safety scandals: High-profile food safety incidents have been rapidly accelerating adoption of traceability technologies, as businesses seek to mitigate risks and protect brand reputation – we can expect an increase in market urgency for scalable solutions