The Future Faster: Corporate Sustainability Monitoring

2019 saw an outpour of corporate declarations to reduce emissions before 2030–2060 to improve overall corporate sustainability. But corporate sustainability impact goes beyond just carbon emissions. Companies need also to consider metrics like water, waste, resource use, biodiversity and pollution. In setting such specific goals, many companies are seeking quantifiable tools to first understand where their impact is today, and to then determine where they need to go, and how they can get there most efficiently.

Innovators are creating SaaS platforms and plug-in APIs for companies to accurately, transparently, and sometimes autonomously, measure and monitor emissions, environmental impact and climate risk exposure. SaaS business models allow carbon accounting software start-ups to quickly scale. The data can then be used to form roadmaps aligned with corporate goals and feed into regulatory and voluntary reporting frameworks.

Some providers offer additional services like consultancy to guide mitigation and adaptation actions or data training to promote reporting accuracy. Others are providing product analysis and life-cycle assessment so companies can assign a carbon or water score to the products they sell. Some also offer a marketplace for companies to purchase offsets.

Most of these offerings focus on carbon accounting, the process by which organizations quantify their greenhouse gas (GHG) emissions, whilst other sustainability metrics, like water and biodiversity impact, are rarely integrated.

Ecosystem biodiversity refers to the variety of ecosystems, by their nature and number, where living species interact with their environment and with each other. Accurately measuring the impact of a company operating in multiple ecosystems would be a logistical nightmare. However, despite this complexity, industry is developing risk assessment methodologies (e.g., The Taskforce on Nature-Related Financial Disclosures) while innovators are developing impact assessment tests (e.g., Nature Metrics Environmental DNA test kits).

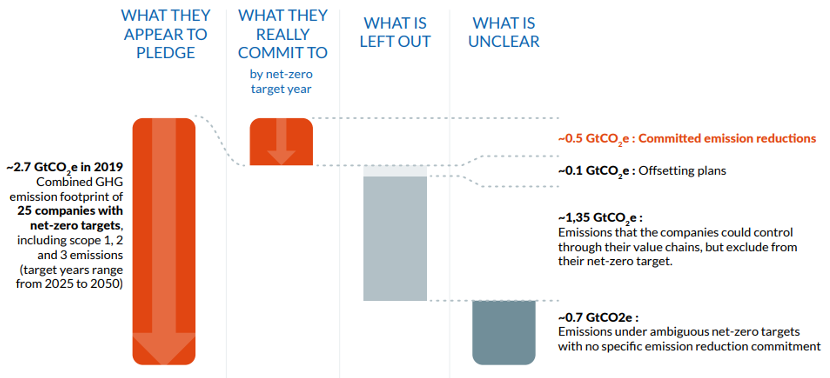

Decarbonization’s Integrity Problem

Current corporate action on decarbonization has an integrity problem, with many companies only committing to decarbonize by 40% on average (See Figure 1). This has resulted in a huge accuracy gap in current reporting, opening the door for more accurate measuring tools.

Sustainability monitoring tools, like carbon accounting, bring transparency to commitments and enable investors, regulators and customers to assess if corporate actions are aligning with their commitments.

2021 saw exponential growth in later stage funding in Emissions Monitoring (EM), with innovators like Persefoni raising over $100 million in 2021, while Watershed and Ecovadis raised $70 million and $500 million, respectively, in 2022. These innovators, and others, highlight fast sector growth, referring to investment highlights, but also represent the ‘traditional’ purely emissions monitoring companies.

- Persefoni develops carbon footprint management and reporting software for corporates. Through a strategic partnership, Bain & Company combines its expertise in carbon transitions and its understanding of investor’s priorities with Persefoni’s platform to help Bain’s clients manage their carbon inventory.

- Watershed announced a development partnership with Quantcast earlier this year to provide services that include measuring and reporting on their carbon footprint by providing real time data on carbon emissions, modelling future carbon footprint scenarios and developing a pathway forward to reduce emissions.

- Measurabl is a developer of sustainability reporting software for real-estate. Their strategic partnership with Colliers International has allowed Collier to augment its Property Management offering with Measurabl’s ESG data management and reporting expertise to help clients better manage, measure, disclose and act on their portfolios.

Decarbonization is not Sustainability

Current corporate monitoring tools focus on carbon accounting. The integration of other sustainability metrics, like water and biodiversity impact, is not a common feature. This is due to lower consumer awareness, less regulatory pressure and practically, and the fact that some metrics are less tangible without existing and accepted measures, let alone strong methodologies.

Mainstream sustainability monitoring is primarily focused on carbon-based Environmental UN Sustainable Development Goals (SDGs) (see Figure 2), a holistic framework to look at corporate sustainability impact beyond carbon emissions. Companies mainly focus on 13, 12, and 7 in the figure below, but for accuracy, assessments should integrate all environmental metrics to align with the SDGs.

Carbon: A 2017 report by the CDP found that only 100 companies were responsible for almost 70% of global GHG emissions, most of which were oil and gas or mining companies. From these 100 companies, 41% were investor-owned, highlighting high financed emissions.

Waste & Circularity: Commercial and Industrial (C&I) waste production varies dramatically between companies and by country. In the UK, total C&I waste generated was estimated to be 43.9 million tonnes.

Water: Industry is one of the main water users in Europe, accounting for about 40% of total water abstractions. For manufacturing, water is an increasingly critical resource.

Biodiversity: Metrics to measure biodiversity are yet to be widely utilized. Corporate biodiversity footprints can be calculated via value chains and data from production assets. There are nascent policy drivers to provide explicit financial incentives for nature inclusion and restoration e.g., EU Biodiversity Strategy.

Interesting innovators to highlight are monitoring other sustainability metrics, e.g., nature, circularity and resource use, and water.

- NatureMetrics is a developer of an eDNA analysis service for ecosystem, natural capital, and biodiversity assessment and monitoring. Biodiversity data is delivered safely and sustainably using DNA, helping companies monitor biodiversity in contexts ranging from conservation to environmental impact assessments.

- Circulor supplies traceability software for materials in industrial supply chains, including e-waste and plastic. Some of its industry applications include electric vehicles, extractive industries, plastics recycling, and construction.

- Droople delivers an IoT platform which creates a smart grid for commercial and industrial water use. The company is digitizing 100+ billion water-based assets “off radar” to monitor them, predict their maintenance, and incorporate water and energy efficiency practices.

Looking Ahead

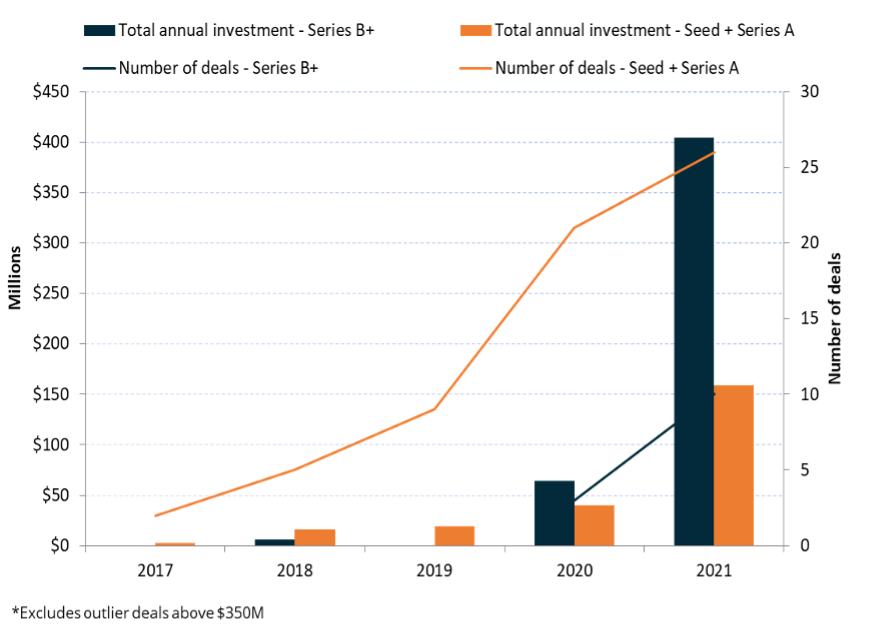

Figure 3 shows the dramatic increase in investments in 2021 accompanied by many more deals in corporate sustainability monitoring tools.

- Carbon accounting software start-ups are quickly scaling due to their SaaS business model and strong demand drivers from corporates and the associated regulation. In comparison, wider sustainability monitoring innovators like NatureMetrics are still in the earlier stages.

- As mentioned, 2021 saw exponential growth in later-stage funding in EM, with innovators like Persefoni, Watershed, and Ecovardis. Newer innovators, such ReFlow and Audette, continue to raise early-stage funding, therefore, we expect the growth of this sector to continue.

- Specialization in improving accuracy of models, scope focus, sector focus and integration with carbon offsets has been observed. Expect to see consolidation with climate risk analytics and other sustainability metric tracking, like water use, circularity, and biodiversity, to offer a one-stop-shop for corporates wanting to measure and track impact, mitigation and adaptation actions.

Corporate sustainability monitoring is getting smarter and faster. We expect continued growth in carbon accounting as drivers develop and accuracy challenges are more widely understood and highlighted. Also expect a broader view of corporate sustainability monitoring to disseminate as methodologies and measuring tools develop. However, there is a fine line to walk between accuracy and bureaucracy, so we expect the market to consolidate and simplify to ensure perfect isn’t the enemy of the good.