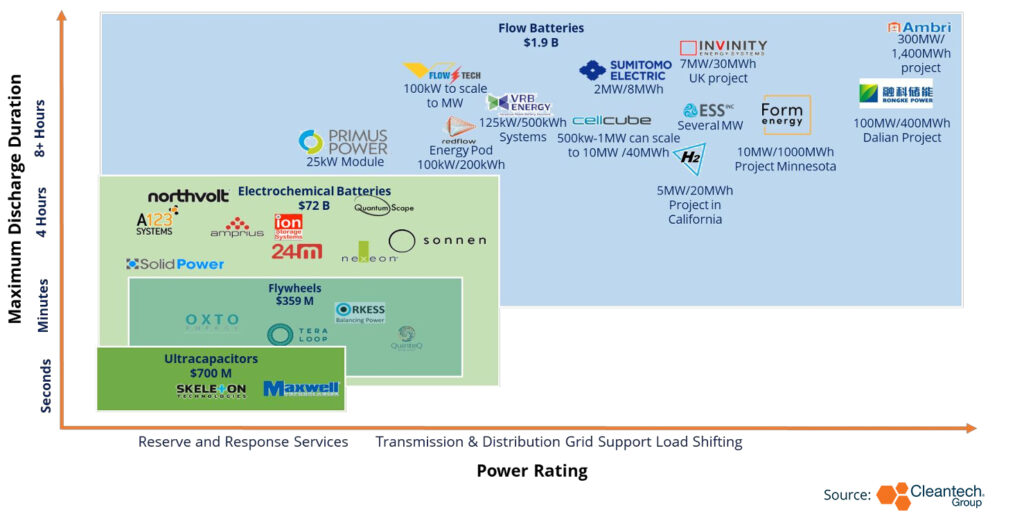

Vanadium Flow Batteries vs. Alternative Battery Chemistries: Who Will Dominate the Medium-to-Long Duration Energy Storage Market Near-Term?

Vanadium Redox Flow Batteries (VRFBs) are proven technologies that are known to be durable and long lasting. They are the work horses and long-haul trucks of the battery world compared to the sports car, like fast Lithium-Ion (Li-Ion) batteries.

However, VRFBs have developed a reputation for being notoriously expensive. New business model and material innovations may drive down costs in the near future, but will it be enough to capture a wider market share of the medium and long duration energy storage market as other battery technologies and chemistries are also looking to develop and commercialize?

The Energy Gap: 4 – 10 Hour Duration

Lithium-Ion batteries, although they can provide energy storage for shorter durations, should not be deep cycled and will only last around eight years, making the cost of ownership and maintenance expensive over time. Additionally, there are associated risks with safety given that when you stack them, they are more likely to catch on fire. They also have fewer avenues for recycling and material recovery. Although Li-Ion batteries are being used for stationary energy storage in many cases, as the growing demand from the wind and solar sectors require longer and longer energy storage durations to be met, Li-Ion batteries do not make much sense from an economic and usage standpoint. So, what will fill the gap?

Flow batteries, energy storage systems where electroactive chemicals are dissolved in liquid and pumped through a membrane to store a charge, provide a viable alternative. VRFBs are the most developed and commercially available type of flow battery currently available on the market. Multiple companies have spun out this technology, further developing and iterating on models, but fluctuating vanadium prices caused many to go bankrupt (e.g., UniEnergy, EnerVault, EnStorage).

Additionally, CapEx costs for VRFBs can be up to 3x more than Li-Ion. Given Li-Ion’s commercial success, it is easy to see why many would want to turn to Li-Ion. Sometimes when all you have is a hammer, everything looks like a nail, as is the case with the rapid commercialization of Li-Ion and their applications for longer duration energy storage.

However, despite the historic volatility associated with VRFBs, the emerging market for medium and long duration storage systems will drive substantial market growth for this sector. In China, a Dalian Rongke project of 100MW/ 400MWh is set to be the largest flow battery on record, almost doubling the previous capacity of flow battery projects worldwide. On top of that, two 1 GWh projects are set to come online in China in 2023 further showing the growing appetite for this technology.

Flow Batteries in the Energy Storage Mix

Key business model and material innovations are lowering upfront costs and improving efficiencies for VRFBs, supporting growth in other markets outside of China where they are not yet widely commercialized.

- Vertical Integration and Electrolyte Leasing: Up to 40-60% of VRFB costs can come from the vanadium electrolyte, and as vanadium prices fluctuate, VRFB manufacturers are looking at models to lease electrolytes to end users to shield them from the fluctuating costs and reduce initial upfront costs. Invinity, CellCube, Largo, Bushveld Minerals and Dalian Rongke are either currently providing, or looking at exploring, electrolyte leasing options. Vanadium can be easily recovered from electrolytes which supports this model. Additionally, primary producers of vanadium, like Largo and Bushveld Minerals, are vertically integrating and supporting the growth of the VRFB sector.

- Humidity and Heat Resiliency: VFlowTech, a Singapore-based VRFB developer, has manufactured a VRFB system that can operate at higher temperatures of around 55°C in humid climates found in South East Asia. They raised $3M in a seed round in 2021 and $10M in a Series A round earlier this year.

- Better Materials, Cell Designs and Management: Incumbent and early-stage VRFB developers are also looking to drive down costs through better cell design, membrane materials and components. VRB Energy has a proprietary low-cost membrane they’ve developed themselves to reduce costs, considering ion exchange membranes can also be a very costly component of the system. Improved sensors and energy management systems are also optimizing VRFB performance with smart charging and improved charging profiles.

As a result, VRFB technologies outside of China are commercializing and seeing investments, as well.

Other notable projects include:

- California – H2, which recently raised $17M in a Series B round, will develop a 5MW/20MWh project in California — one of the largest in the U.S. with SDGE. Sumitomo will invest $7.6M in furthering their VRFB capacity in the U.S. Cellcube and VFlowTech are also expanding in the U.S. S. Vanadium is establishing partnerships with both Cellcube and Invinity to develop U.S. electrolyte manufacturing.

- UK – Invinity is partnering with Energy Superhub Oxford to demonstrate a first of its kind hybrid Li-Ion VRFB BESS system with Wartsila, where a 2MW/5MWh VRFB will be partnered with Li-Ion to provide stable energy storage. The VRFB will cycle first. The Li-Ion will be used to meet peak and fast demands coming from connected systems and the EV charging center. Additionally, Invinity was awarded a grant from DESNZ to develop a 30MWh system using fast response and high-throughput characteristics of the battery and they have partnered with Dawsongroup to expand their rental offerings.

- Australia – Vecco Group received investments to expand vanadium mines from Idemitsu. Vecco Group will develop a partnership with Idemitsu Debella for a vanadium mining project and support for domestic electrolyte manufacturing. It is estimated that up to 30% of the world’s untapped vanadium reserves are located in Australia. Richmond Vanadium also provided $3.5M seed funding to Ultra Power Systems, a new Australian VRFB manufacturing company.

Can VRFBs Capture a Sizeable Portion of the Market Before Cheaper Alternatives Scale?

Despite the strong trajectory for growth of VRFBs in the near future, there will be competition from a variety of alternative battery technologies and innovators rapidly developing and expanding their technology. VRFBs will have to continue to innovate and secure stable vanadium supplies to prove they can keep costs down and maintain efficiency. Strong contenders will come along to capture a portion of the energy storage market share, but the question is how much and how quickly?

Some notable companies include:

- ESS, Ambri, Redflow, and E-Zinc are all companies developing alternative battery solutions with very different chemistries to address the same market of medium-to-long term energy storage and are quickly securing partnerships, developing new projects and investments along with many other members of the Long Duration Energy Council.

- Organic aqueous solutions are a popular non-vanadium flow battery technology that are also seeing quick engagement from investors and project developers. XL Batteries and Quino Energy received investments earlier this year. One of the challenges with organic aqueous solutions is that the active chemicals used can degrade over time, but Quino Energy has developed a specific chemistry that overcomes this crucial challenge.

- Other notable companies leveraging novel chemistries include:

- RFC Power (hydrogen-manganese): Their electrolyte is 10x cheaper than vanadium.

- Noon Energy (CO2-based): They are looking to address the longer duration markets and compete with companies like Form Energy. Noon Energy’s battery can be 90% cheaper than Li-Ion when compared at 100 hours and has a very high energy density.

- Elestor: Recently won an offshore wind innovation award and received investments from energy companies like Equinor.